Dollar Tanks as Fed-Cut Fever Spreads—Forex Reacts with Flair

Quick Summary:

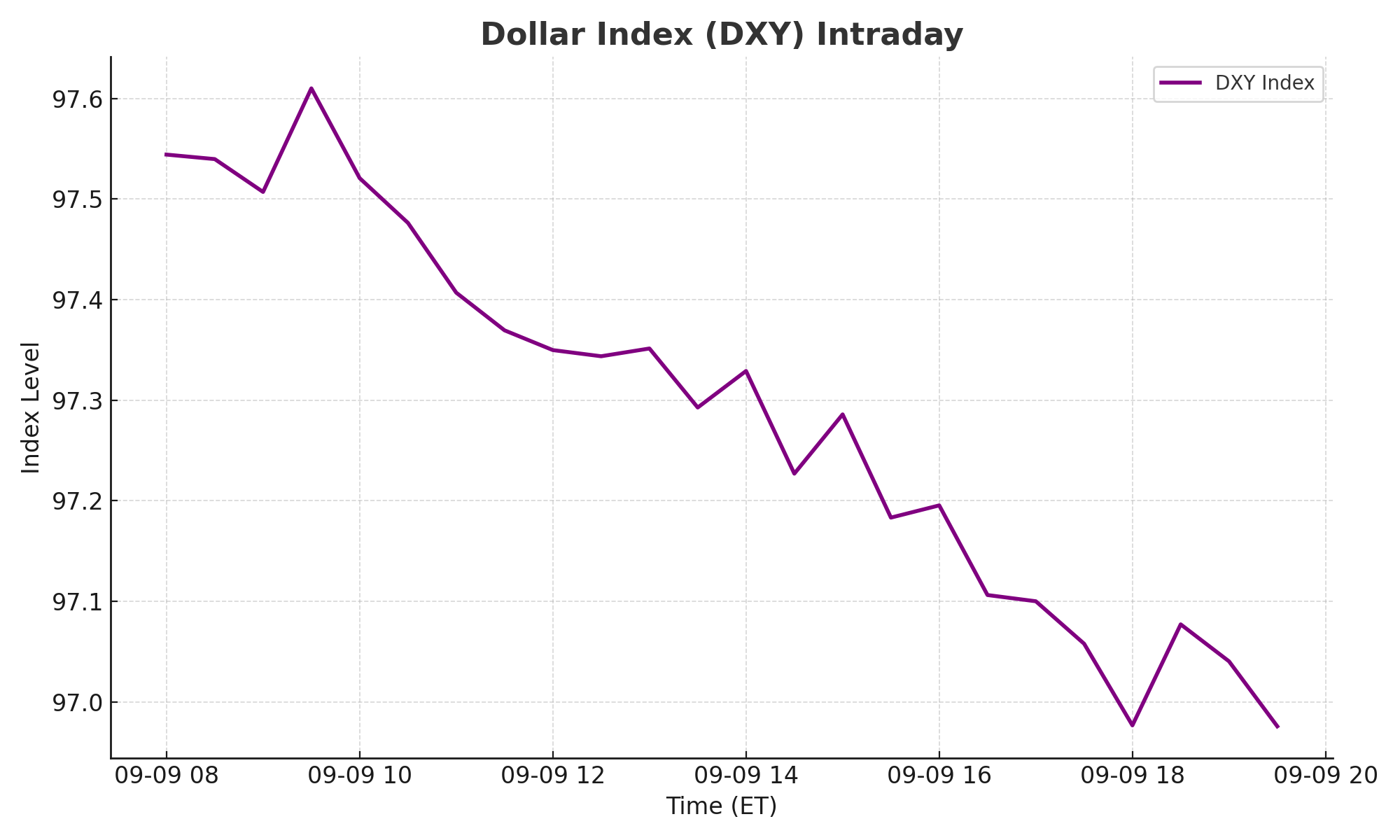

U.S. dollar tumbles to a seven-week low, DXY ~97.32, as Fed-cut bets surge Reuters

EUR/USD dips ~0.5%, trading near 1.1705 Reuters

GBP/USD slides ~0.17%, hovering near 1.352 as sterling flirts with later highs Reuters

USD/JPY eases ~0.08% to about 147.40, yen getting friendlier Reuters

Forecast: Watch PPI data for next volatility trigger; dollar may wobble further but could bounce on inflation surprises.

Intro

The dollar's taken a tumble today, courtesy of some spicy Fed-cut chatter. EUR slipped, pound wobbled, yen got feisty. But don’t overreact—tomorrow’s PPI could flip the script. Ready? Let’s dive in.

Major Currency Pairs

EUR/USD: Swooning about 0.5% lower, teetering near 1.1705. Euro’s strength is matched by dollar weakness. Reuters

GBP/USD: Slight dip of 0.17%, hanging around 1.3520, but holding within recent ranges. Reuters

USD/JPY: Down 0.08%, trading near 147.40. Yen gains on risk sentiment and Fed-cut odds. Reuters

Macro Drivers

Data moves: Dollar sinks as markets price in aggressive Fed easing—expectations of at least 25 bps cut and rising for 50 bps ReutersInvesting.com Australia

Gold is flying—investors loading up amid Fed-cut fever. Reuters

Forward focus: Eyes on PPI, next big macro moment. Can inflation surprise to the upside and save the dollar?

24-48-Hour Forecast

Short-term: Expect continued dollar softness. EUR/USD and GBP/USD may test upper ranges. USD/JPY could break 147.50 if yen momentum holds.

Risk to flip: If PPI prints hotter-than-expected, greenback could rebound—especially in rate-sensitive pairs.

Practical Impact for Traders

Pare a few pips: consider long EUR/USD or GBP/USD with tight stops.

Watch Japan politics: Prime Minister’s news could swing yen quickly.

Gold remains a safe-haven darling—hedge your exposure.

Keep PPI radar on—that’s your volatility switch.

FAQ

Q: Why did the dollar drop so sharply today?

A: Rising expectations of Fed rate cuts.

Q: Can EUR, GBP continue to rally?

A: Yes—if dollar stays soft and U.S. data doesn’t surprise.

Q: What’s the Fed’s next move?

A: PPI will guide. A hot print may delay cuts; a soft one deepens bets.

Related Articles

Bitcoin Tanks—Then Bounces; Stocks Quietly Climb vs USD usdxchange.com

Dollar Slides as Risk Assets Rally, Bond Yields Plunge usdxchange.com

Disclaimer: This information is for educational purposes only and is not investment advice.

Sources:

Reuters: Dollar falls 7-week low, Fed-cut chances rising Reuters

Reuters currency snapshot: EUR/USD, GBP/USD, USD/JPY moves Reuters+2Reuters+2

Reuters: Market optimism, stock futures, gold record Reuters

Reuters Asia FX: Dollar slips 7-wk low, yen and rupee gain Reuters