Dollar Slides as Risk Assets Rally, Bond Yields Plunge

Quick Summary

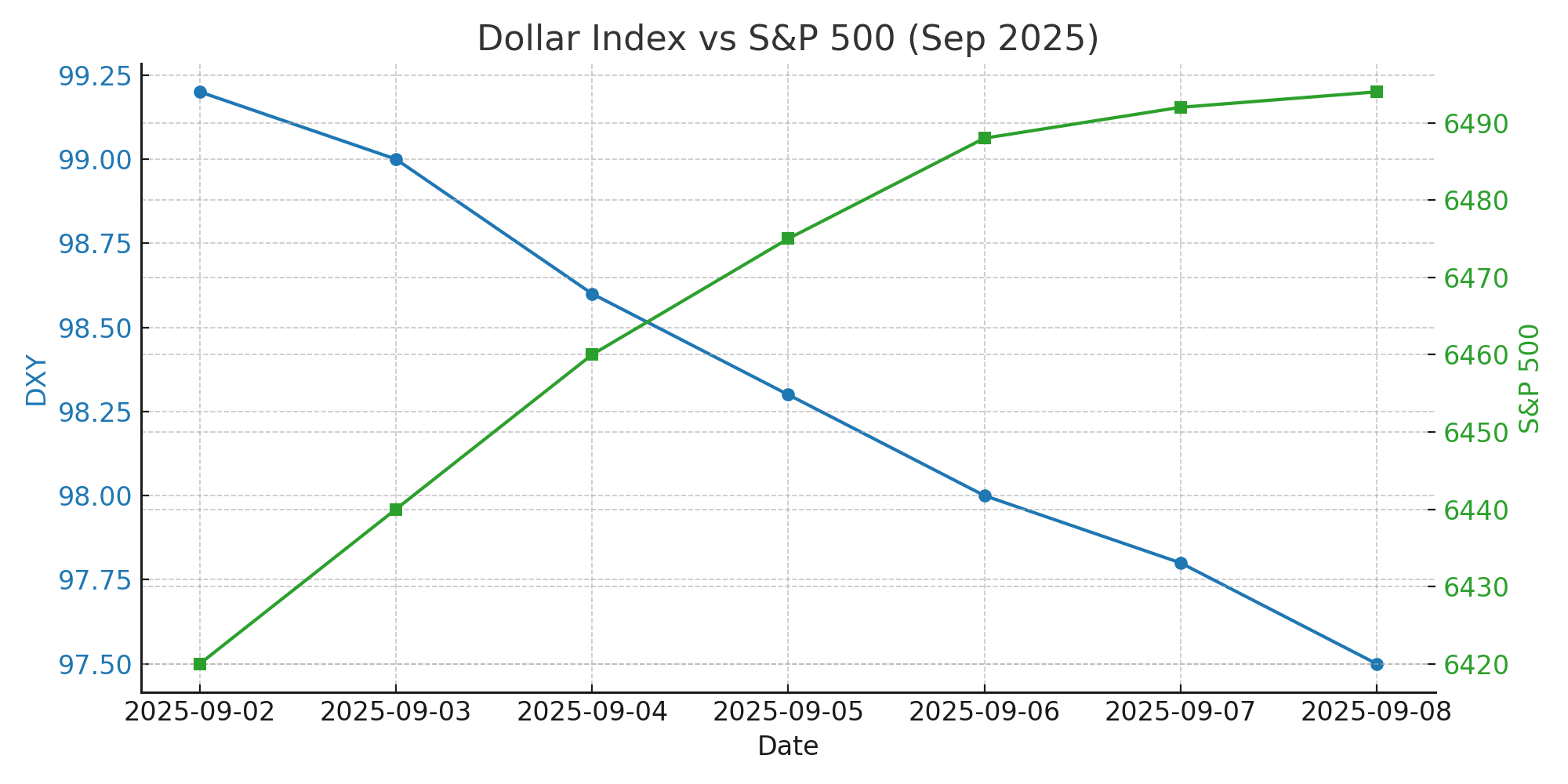

US Dollar Index (DXY) down ~0.25%, testing 97.5 level as hopes for Fed easing grow Investing.comInvesting.com UKReuters.

S&P 500 +0.20%, Nasdaq +0.53%, Dow +0.03% (around 14:35 ET) as risk sentiment surges Reuters.

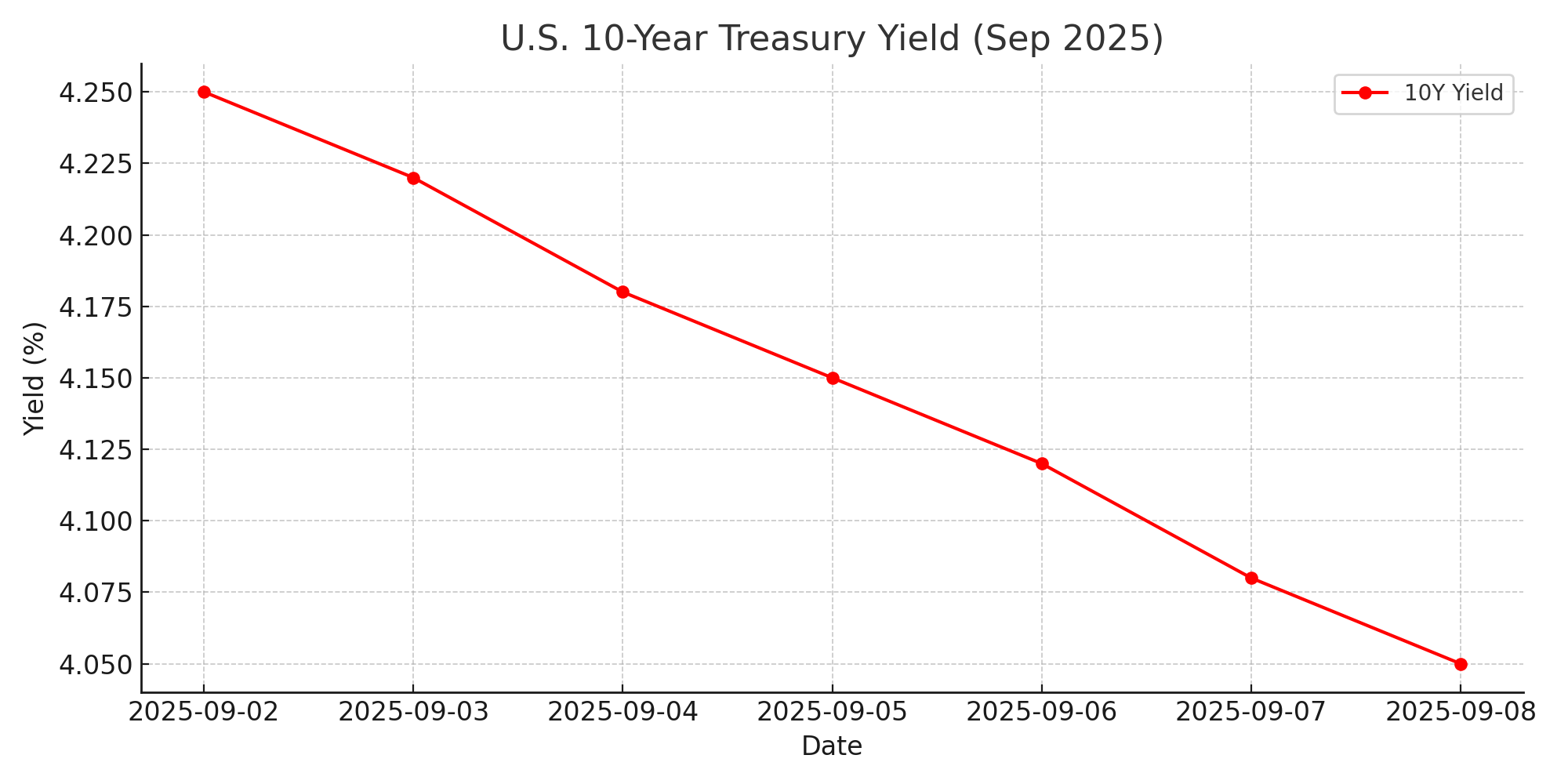

10-year Treasury yield dropped ~4 bps to ~4.05%—lowest in months Reuters+1FinancialContent.

Yen slid ~0.5-0.6% vs. USD on Japanese PM’s resignation; dollar broadly weaker Reuters+1.

Global markets up: Europe futures +0.45%, Nikkei +1.8%, gold near highs Reuters.

Intro

Here’s what’s moving markets today: the dollar is sliding, equity indices are rallying, and bond yields are collapsing. Weak U.S. jobs data turned Fed rate-cut speculation into a tidal wave—and risk assets are riding it. At the same time, yen woes from political turmoil in Japan are adding spice. In my view, this is the trade of the moment: long stocks, short the dollar, fade yields. But stay nimble—central bank moves still lurk. This isn’t guesswork. The numbers are speaking, and they’re screaming about policy shifts ahead. Not financial advice, but watch this space.

U.S. Markets Overview

Equities:

S&P 500 up +0.20% to 6,494.61

Nasdaq up +0.53% to 21,814.90

Dow Jones modest gain +0.03% to 45,416.36 Reuters

Bond Yields:

10-Year Treasury around 4.05%, down ~4 bps from prior close Reuters+1

USD:

Dollar Index dropped ~0.2–0.3% to ~97.5 Yahoo FinanceInvesting.comInvesting.com UKReuters

USD Impact on Global Markets

Asia & Japan: Yen plunged ~0.5–0.6% after PM resignation, amplifying dollar weakness Reuters.

Europe: Futures rose ~+0.45%; equities rally on easing rate fears Reuters.

Emerging Markets & Commodities: Weak dollar fuels gains; gold near record highs (~$3,588/oz) Reuters.

Prediction & Outlook

What I’m watching:

In my view, the dollar’s descent has room to run—if the September rate cut is even hinted at, expect it sub-97. Equity upside could break into new green zones—Nasdaq possibly flirting with +1% if sentiment holds. Bond yields? A wash for now—but a dovish Fed could push 10-year yields toward 4.0% or below soon. Balanced, but leaning bullish on risk assets, bearish on dollar and yields.

Key Takeaway for Traders

USD weakness = equity lift: Good day for longs in tech, cyclicals.

Bond breakup: Yields tumbling. Be cautious with fixed income duration exposure.

Watch yen: More political headlines out of Tokyo may keep volatility high.

Gold strength signals real-money flows: keep tabs if you're trading metals or miners.

FAQ

Q: Why did the dollar slide today?

A: Weak U.S. payrolls (only ~22K jobs added) sent Fed rate-cut expectations higher, undermining the dollar Investing.com UKReuters.

Q: Is the rally in stocks sustainable?

A: For today, yes—Fed easing expectations are fueling momentum. But if data flips, this rally could retrace fast.

Related Articles

Entering Bond Trades? Here’s What Bond Yields Are Telling Us

USD Converter: Track Real-Time Dollar Movements Against Global Currencies

Sources:

Stocks climb, dollar weakens amid rate-cut bets, yen slides Reuters+1Investing.com

Equities performance: S&P +0.20%, Nasdaq +0.53%, Dow +0.03% Reuters

Bond yields: 10-Year Treasury ~4.05%, lower Reuters+1FinancialContent

Dollar Index ~97.5, down ~0.25% Yahoo FinanceInvesting.com UKReuters

Disclaimer: This information is for educational purposes only and is not investment advice.