Dollar Drops on Weak Jobs, CPI Now in Focus

Quick Summary

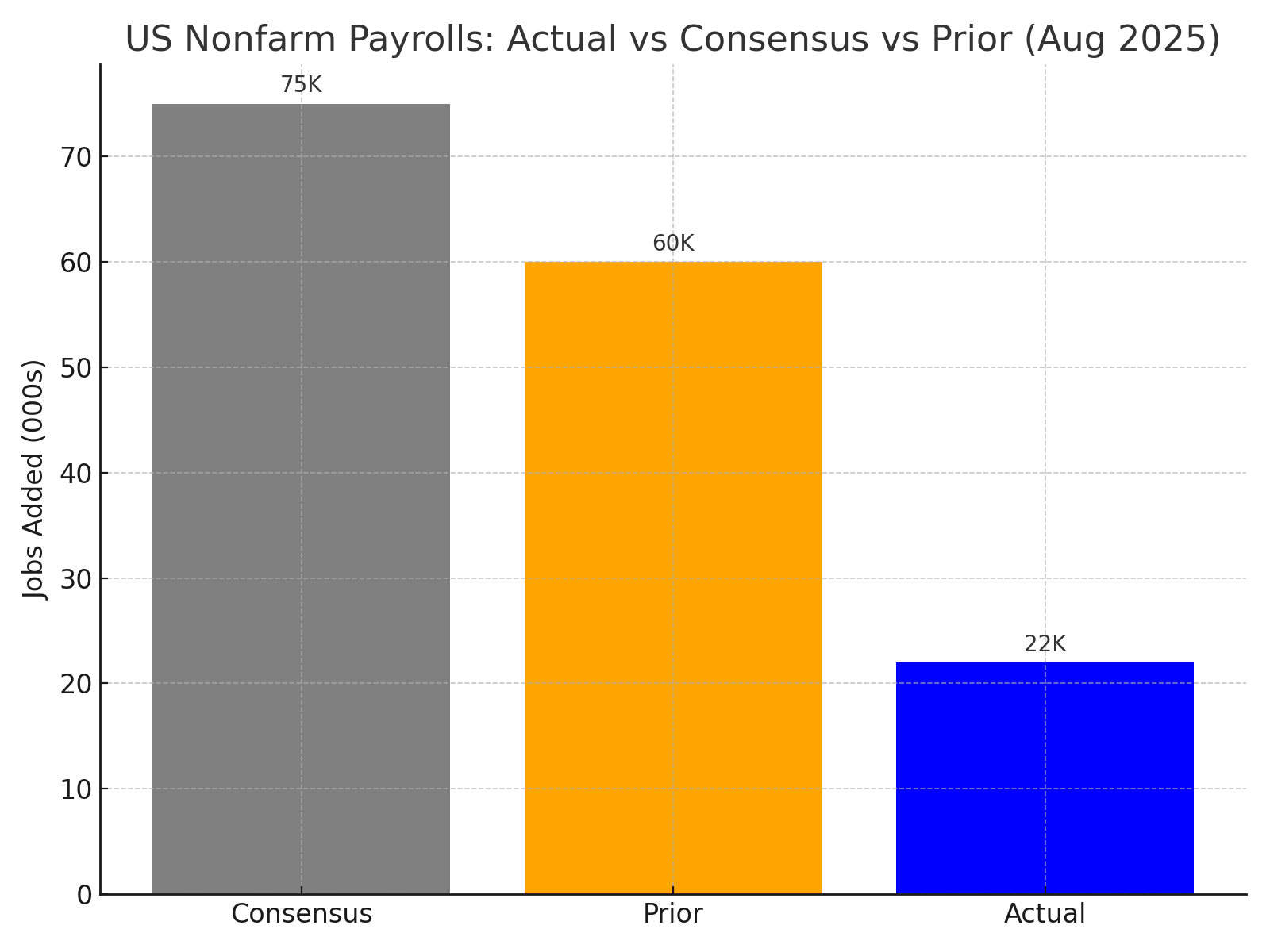

U.S. Nonfarm Payrolls (NFP) added just 22K jobs in August vs. 75K expected; prior revised to 60K.

Unemployment rate ticked up to 4.4% from 4.3% (bls.gov, reuters.com).

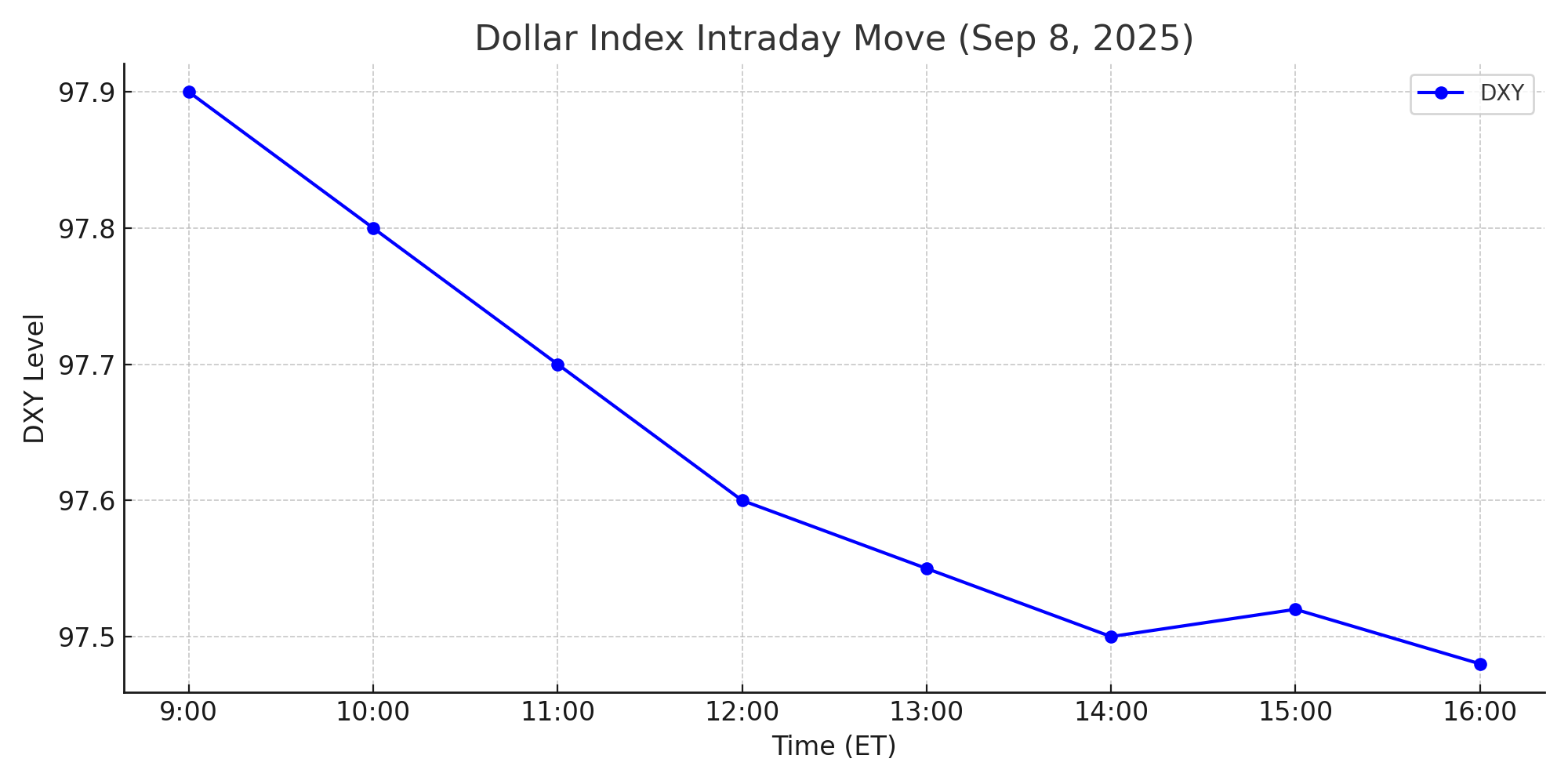

Dollar Index (DXY) slid ~0.25% to 97.5 at 14:35 ET.

10-Year Treasury yields down 4 bps to 4.05%.

Markets now eye CPI release later this week as the key driver of Fed policy.

Intro

Economic data set the tone today. The U.S. added just 22K jobs in August, far below forecasts, pushing the dollar lower and stoking Fed rate-cut speculation. Treasury yields slipped and equities caught a bid as traders priced in more aggressive easing. Unemployment edged up, underlining a labor market that’s losing steam. With payrolls out of the way, all eyes turn to the upcoming Consumer Price Index (CPI) report later this week, which could confirm or challenge the Fed pivot narrative.

Today’s Economic Calendar

Nonfarm Payrolls (NFP): +22K vs +75K expected; prior revised down to +60K.

Unemployment Rate: 4.4% vs 4.3% expected.

Average Hourly Earnings: +0.2% m/m vs +0.3% expected; prior +0.3%.

Data from BLS, cross-checked with Reuters and Investing.com.

Market Reactions

Dollar Index (DXY) fell ~0.25% intraday, sitting at 97.5 at 14:35 ET.

EUR/USD gained ~30 pips to 1.1120.

USD/JPY steady near 144.90 despite yen weakness from Japanese politics.

10-Year Treasury Yield: down 4 bps to 4.05%.

S&P 500 +0.20%, Nasdaq +0.53% as stocks welcomed weaker dollar and lower yields.

Prediction & Forward Outlook

The jobs miss confirms slowing momentum in the U.S. economy. In my view, the dollar will stay pressured into Wednesday’s CPI print. If inflation softens even slightly, Fed officials will find cover to move on cuts. On the flip side, a hot CPI could whipsaw markets back the other way. I’d expect DXY to test 97.0 if CPI is benign, with a rebound toward 98.5 if inflation surprises.

Key Levels to Watch

DXY support: 97.0 (break here signals deeper USD selloff).

EUR/USD resistance: 1.1150 near-term cap.

US10Y yield floor: 4.0%—any dip under this would mark a major bond rally.

FAQ

Q: Why did the dollar weaken after NFP?

A: The miss (+22K vs 75K expected) boosted Fed rate-cut expectations, undermining the dollar.

Q: Which event is most important next?

A: CPI mid-week. It will determine whether the Fed leans harder into cuts.

Q: Did equities benefit?

A: Yes. Lower yields and a softer dollar gave stocks breathing room.

Related Articles

Sources:

U.S. Bureau of Labor Statistics NFP release (bls.gov)

Dollar, bonds, stocks reaction (reuters.com)

Investing.com calendar overview (investing.com)

ForexFactory calendar (forexfactory.com)

CPI preview commentary (bloomberg.com)