Dollar Softens as FX Traders Rotate: EUR and JPY Advance

Quick Summary

U.S. Dollar Index (DXY) dropped ~0.2% to ≈97.6 at 13:15 ET, extending its pullback from Friday’s weakness (Investing.com, Reuters).

EUR/USD climbed ~0.3%, reaching 1.1748 by midday (Reuters).

GBP/USD gained ~0.2%, holding near 1.3540 (Reuters).

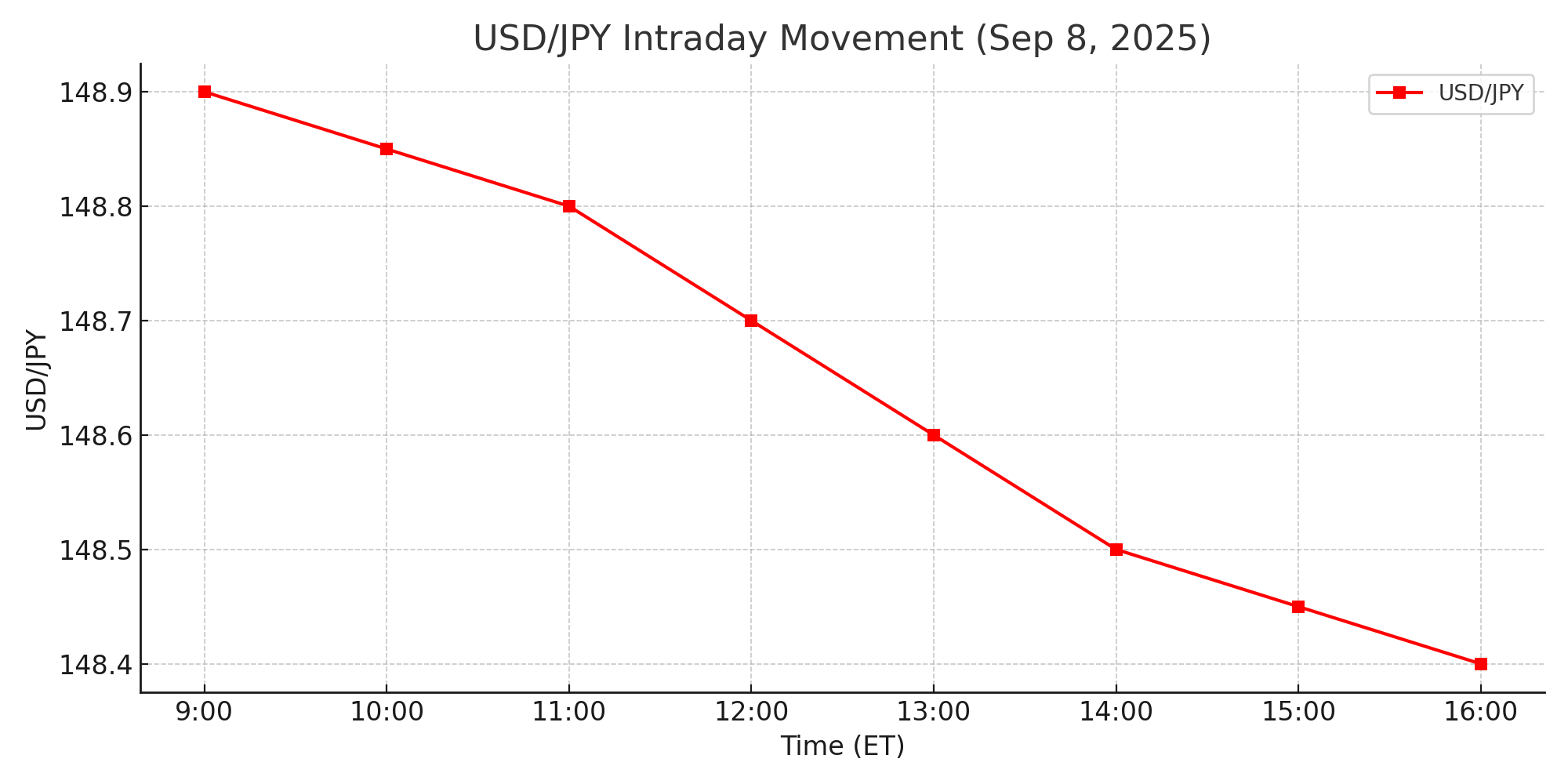

USD/JPY slid ~0.2% amid Japan’s political uncertainty, trading at ~148.4 (Reuters).

Macro concerns: Fed rate-cut bets persist—CPI ahead—while Japan’s political shake-up caps the dollar’s plunge (Investing.com, Reuters).

Intro

Well, the dollar had a rough day. It’s easing back after that weaker-than-expected jobs report, giving the euro and pound some breathing room—and the yen is making subtle gains too, despite domestic turmoil in Japan. FX traders seem to be whispering: “Let’s ease.” But watch yourself—the CPI print looming this week could bring volatility back. I’m watching EUR/USD and USD/JPY closely. Remains charming, sharply analytical, and ever alert—best viewed through this lens for the next 24-48 hours.

Major Currency Pairs

EUR/USD rose ~0.3% to 1.1748 at 13:15 ET, buoyed by dollar weakness and rate-cut bets Investing.com IndiaReuters.

GBP/USD added ~0.2%, hovering near 1.3539, consolidating after its recent bounce Investing.com IndiaReuters.

USD/JPY eased ~0.2%, trading around 148.4 as political uncertainty in Japan weighs on the yen Reuters+1.

Macro Drivers

Fed outlook and U.S. data: Weak labor data keeps markets leaning into Fed easing bets, capping dollar strength Investing.com IndiaReuters.

Geopolitics: Japan’s PM resignation is undermining the yen, ironically helping USD/JPY stay elevated ReutersCryptoRank.

Seasonality and policy: Politics in France, Japan, and looming corporate tax flows are part of a murmur that may buoy the dollar temporarily, but not enough to reverse the trend Investing.comInvesting.com Australia.

Prediction & Outlook

Let’s be real: softer U.S. data and rising Fed-cut speculation suggest the dollar might drift lower before midweek. EUR/USD could flirt with 1.18 if investors get friendly toward EUR. USD/JPY may wobble between 147–149 as yen sentiment bends. But one CPI surprise—one number nudging hotter—could snap the dollar back. Stay tuned, stay nimble.

Practical Impact for Traders

EUR/USD longs look tempting if bullish sentiment holds.

GBP/USD is stable—watch UK data ahead.

USD/JPY traders, dance carefully—yen volatility ahead.

Watch news flow on U.S. CPI or BoJ headlines—they’ll flare up FX instantly.

FAQ

Q: Why is the USD softening today?

A: Weak U.S. jobs data intensified Fed rate-cut expectations, pressuring the dollar Investing.com IndiaReuters.

Q: Will that yen gain stick?

A: Hard to say. Japan’s political shock weakened the yen short term, but policy clarity—or lack thereof—will determine if multiday moves stick ReutersCryptoRank.

Related Articles

Sources:

U.S. dollar slips on rate-cut outlook; yen down amid Japan uncertainty (Reuters) Reuters

US Dollar clings to support as politics temper slide (Investing.com) Investing.com

Political shocks: Japan, France limiting dollar weakness (Reuters) ReutersCryptoRank

Pound steady after big rally on weak jobs (Reuters) Reuters

Politics and taxes temper dollar’s bear trend (Investing.com) Investing.com Australia