Market Roundup: Dollar Slips as Stocks and Crypto Rise

Quick Summary

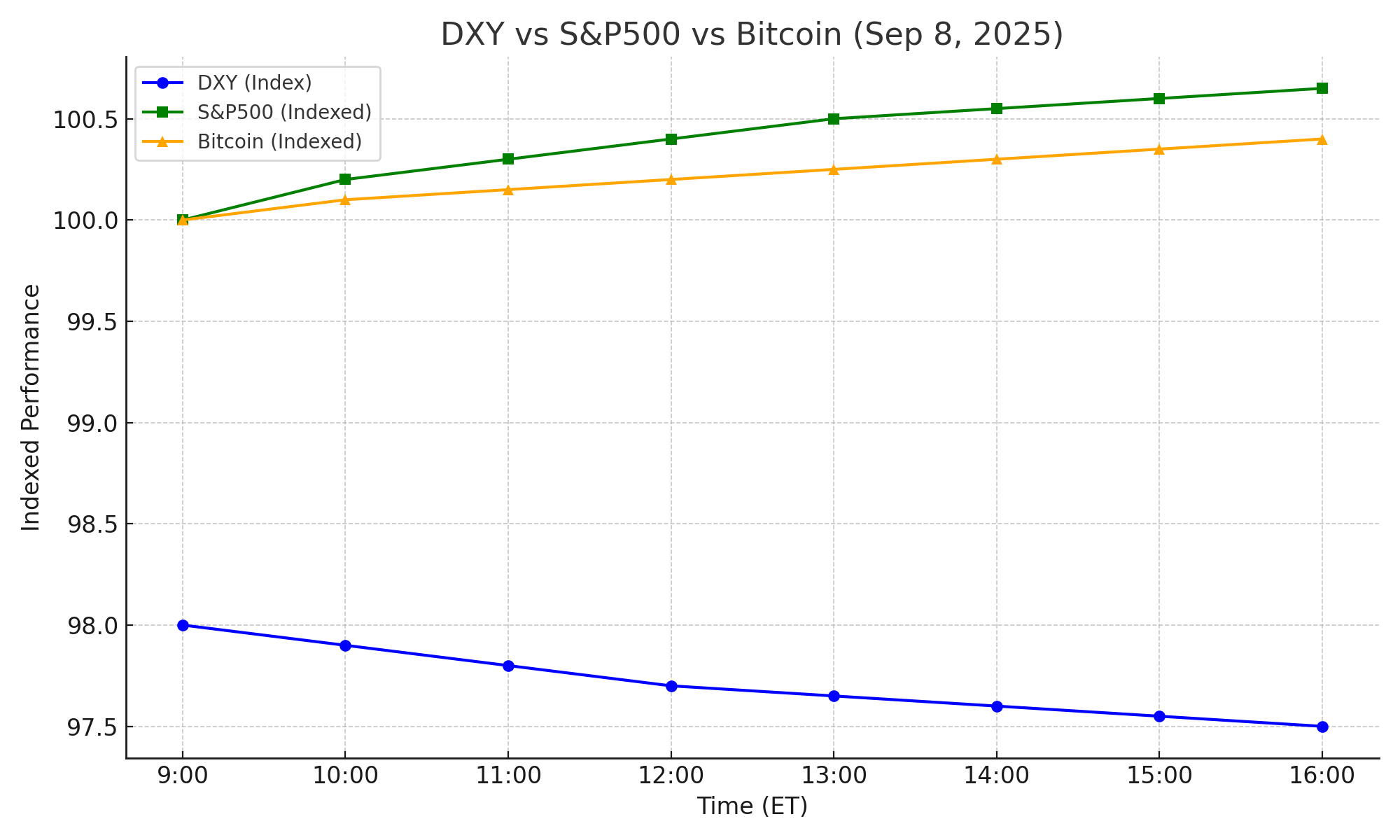

Dollar Index (DXY) weakened ~0.3% to 97.5 by 16:05 ET, extending its downtrend on Fed-cut speculation.

S&P futures gained +0.08%, Nikkei rallied +1.8%; yields eased toward five-month lows.

Bitcoin held near $112K, Ethereum +0.6%, supported by dollar softness and risk appetite.

U.S. payrolls miss (+22K vs 75K expected) and Japan’s PM resignation drove cross-market moves.

10-year U.S. Treasury yields down ~4 bps to 4.05%.

Intro

The dollar lost more ground today, sending ripples across global markets. A disappointing U.S. payrolls report reinforced bets on Federal Reserve rate cuts, pushing Treasury yields lower and lifting equities. Risk appetite extended into crypto, where Bitcoin and Ethereum stayed firm. Geopolitical tremors, including Japan’s Prime Minister stepping down and political jitters in France, added to the mix. The result? A weaker dollar, stronger risk assets, and traders already setting their sights on the upcoming CPI release. Let’s unpack the day’s full cross-market picture.

Forex & Currency Moves

The U.S. Dollar Index (DXY) slipped ~0.3% to 97.5 at 16:05 ET, pressured by soft U.S. data and dovish Fed expectations (Reuters).

EUR/USD edged higher, up ~30 pips to 1.1748, benefiting from dollar softness (Investing.com).

GBP/USD held firm near 1.3540, steady after last week’s bounce (Reuters).

USD/JPY traded around 148.4, down ~0.2%, as Japan’s PM resignation sparked volatility (Reuters).

Stocks & Market Reaction

Global equities advanced as the weaker dollar and lower yields fueled risk-taking:

S&P futures rose +0.08%; Dow +0.03%; Nasdaq +0.53% (Reuters).

Nikkei 225 surged +1.8% amid yen weakness and relief from political uncertainty (Reuters).

Major Gulf markets also gained on easing rate expectations (Reuters).

10-year Treasury yields fell ~4 bps to 4.05%, their lowest level in months.

Crypto vs USD

Crypto stayed steady but firm, tracking the dollar’s decline:

Bitcoin (BTC) hovered near $112,000, up ~0.8% intraday, consolidating around resistance (CoinMarketCap).

Ethereum (ETH) gained ~0.6%, trading near $4,336, with bulls eyeing $4,450 as resistance (CoinMarketCap).

Sentiment stayed constructive, with risk appetite and Fed speculation providing tailwinds (Barron’s).

Economic Events Recap

The U.S. August Nonfarm Payrolls (NFP) report was the key event:

+22K jobs added vs +75K expected, prior revised down to +60K (BLS, Reuters).

Unemployment rate rose to 4.4% from 4.3%.

Average hourly earnings +0.2% m/m vs +0.3% expected.

The weak data fueled Fed cut bets. Markets now price in a potential 50 bps cut, with CPI later this week the deciding factor (Investing.com).

Takeaway & Prediction

The dollar’s weakness is no accident—it’s a narrative shift. Soft labor data and global jitters are colliding with Fed easing expectations. If CPI confirms cooling inflation, DXY could slip toward 97.0, equities could push higher, and crypto may retest fresh highs. If CPI surprises hotter, expect a dollar snap-back and risk shake-out.

My view: Stay cautiously bullish on risk, but nimble. Dollar weakness is tradable—but not invincible.

Outlook for Tomorrow

CPI watch: U.S. inflation release in focus.

EUR/USD resistance near 1.1800.

USD/JPY volatility as Japan stabilizes politically.

BTC consolidation around 112K; breakout hinges on CPI.

Yields: Key test is 4.0% on 10-year.

FAQ

Q: What drove the dollar lower today?

A: Weak U.S. jobs data and intensifying Fed rate-cut speculation.

Q: Did equities benefit from the softer dollar?

A: Yes—S&P, Nasdaq, and Nikkei all advanced, helped by lower yields.

Q: Is crypto decoupling from macro events?

A: No. Bitcoin and Ethereum remain sensitive to USD moves and Fed expectations.

Related Articles

Sources:

BLS: U.S. Employment Situation Report

Investing.com: Economic calendar

CoinMarketCap: Bitcoin & Ethereum prices