Bitcoin Holds Fort at $112K as Stocks Ride Rate-Cut Hype

Quick Summary

BTC/USD holds near $112K, up ~1% intraday, consolidating around key resistance amid breakout speculation The Economic TimesCoinGecko.

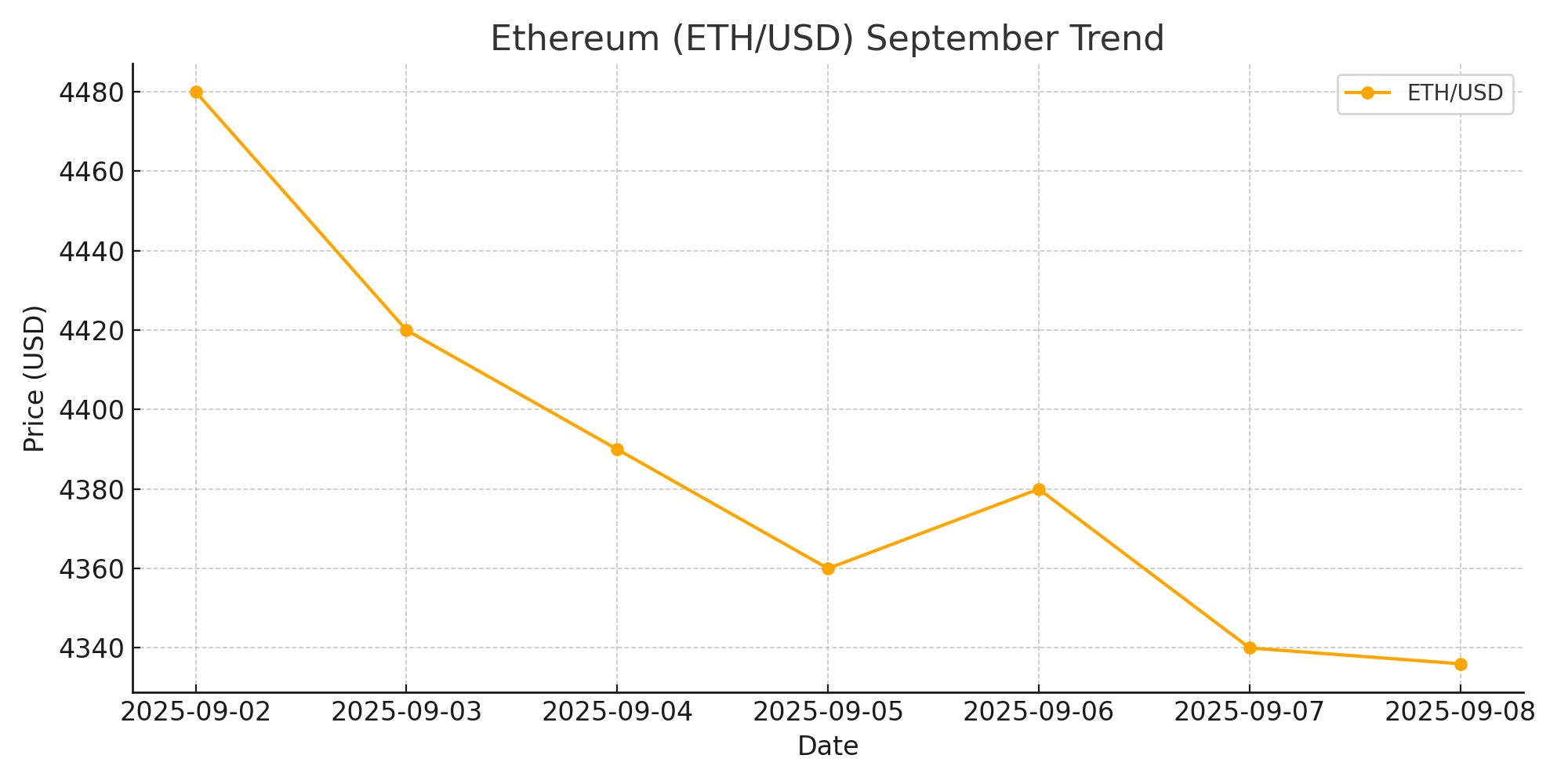

ETH/USD hovers around $4,336, slipping slightly (~0.2–0.3%) over the last hour, down ~2.5% in past 24h—bears sniff downside risk CryptoRankTradingViewblockchainreporter.

US stocks rally (S&P futures +0.08%, Nasdaq near new highs) thanks to weak labour data fueling Fed rate-cut optimism Reuters+1Investopedia.

Global equities climbing broadly; Dow futures, Nikkei up—risk-on mood powered by easing Fed outlook Reuters+1CryptoRank.

Today, the dollar is trembling and markets are lit—Bitcoin locked near $112K, Ethereum wobbles, and stock indices are ripping higher on whispers of a Fed pivot. I’m not here to blend in—I say this: this setup is screaming "buy the dip," even if the herd is busy fretting. The data is unambiguous: weak jobs data kicked the Fed into dovish overdrive, and both crypto and equities are racing to price in the easing. Strap in—this is contrarian energy backed by numbers, not hope.

Crypto vs USD — BTC/USD and ETH/USD, Sentiment and Drivers

BTC/USD: Holding at $112K, up ~1% intraday, with resistance at ~$113K. Experts see consolidation around this level as a potential launchpad—or a breakdown back to $100K The Economic Times+1CoinGecko.

ETH/USD: Flirting with $4,336, down ~0.2–0.3% in the last hour and down ~2.5% over 24h—the classic “recovery wave failed past $4,450” scenario spells risk if bears break $4,220 CryptoRankblockchainreporterTradingView.

Stocks vs USD — S&P, Nasdaq, Global Equities vs USD

US stocks: S&P futures +0.08%, Nasdaq hitting new highs; bulls are betting the Fed will cut rates amid weak jobs data (just 22K added vs 75K expected) Reuters+1Investopedia.

Global indices: Nikkei +1.8% as yen weakens on political uncertainty; European futures up ~0.45%; global markets riding rate-cut optimism Reuters+1CryptoRank.

Patrick’s Prediction

My Take (opinion): Bitcoin is readying for a breakout. If it flips $113K, we’ll test $120K within days. Ethereum? Risky if it cracks $4,220—I’m bearish there until bulls prove strength above $4,450. In equities, this rate-cut narrative has legs—S&P and Nasdaq break higher as the dollar weakens.

Why It Matters

Trade setups: BTC consolidation tightens your entry range; breakout targets clear.

Risk-reward clarity: ETH is a setup oozing asymmetry—short if $4,220 fails.

Dollar-drama: Weaker dollar fuels commodities, equities—know your exposures.

Policy tailwinds: Fed pivot means real money starts chasing risk. Be early.

FAQ

Q: Is Bitcoin likely to break above $113K soon?

A: If bulls hold above $112K and volume picks up, yes—resistance sits at ~$113K. Watch for a breakout or a rejection that dumps it to $100K if it fails.

Q: What’s the trigger behind stock gains?

A: Weak US labor data—just 22K jobs added vs 75K expected—ignited Fed rate-cut optimism, pushing indices higher and trimming the dollar’s edge Reuters+1.

Related Articles

Sources:

Bitcoin holds around $110–112K, consolidation noted The Economic Times

Ethereum struggling post-$4,450 rally, possible slide below $4,220 CryptoRankblockchainreporter

BTC price live ~112K from CoinGecko/CoinMarketCap CoinGeckoCoinMarketCap

ETH live ~4,336, 0.2% hourly drop TradingViewCoinGecko

Stocks rally on rate-cut hopes, weak labor data, S&P/Nasdaq futures up Reuters+1Investopedia

Global equities: Nikkei +1.8%, European futures +0.45% ReutersCryptoRank

Disclaimer: This information is for educational purposes only and is not investment advice.