Dollar Tumult Ripples Across Forex, Stocks, Crypto Today

Quick Summary:

Dollar slumps to a seven-week low (DXY ~97.32), as rate-cut expectations skyrocket.

Forex pairs: GBP climbs (1.3585), EUR steadies ($1.172), USD/JPY eases (~147.4).

Stocks inch higher: S&P +0.2% (6,509), Nasdaq touches new highs; gold hits fresh record ($3,660/oz).

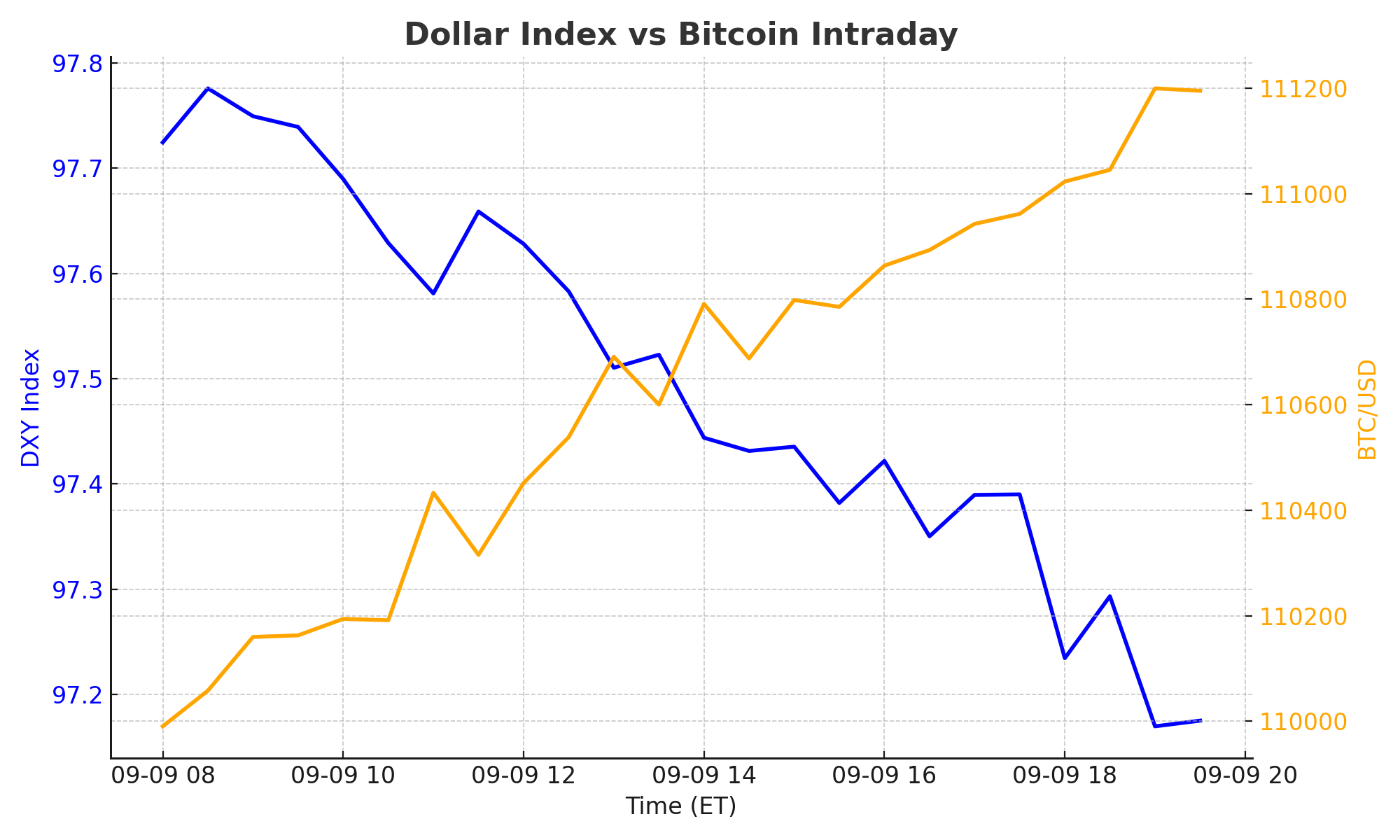

Bitcoin sits around ~$111,000 as USD weakness boosts crypto sentiment.

Jobs data drama: massive payroll revision shocks markets; eyes now on PPI.

Intro

Published: September 9, 2025 18:00 ET — What a day. The dollar was the star of the show plunging as markets priced in aggressive Fed cuts. That sent ripples from yen to bitcoin, stocks to gold. Weak employment data added fuel to the fire, and now all eyes pivot toward tomorrow’s PPI. It’s one of those “wake-up” days in USDland packed with moves, mood shifts, and opportunity. Here’s how it all unfolded.

Forex & Currency Moves

Dollar Index (DXY) tumbled to ~97.32 in Asian session—a seven-week low, as of ~08:30 ET, tracking soaring rate-cut bets. ReutersMitrade

GBP/USD jumped ~0.3% to 1.3585, its highest since mid-August. Reuters

EUR/USD steadied around 1.172, modest gains amid political jitters in Europe. Reuters

USD/JPY eased by ~0.3% to ~147.4—yen strengthening amid dollar slide. Reuters+1

Forex traders? The views diverged sharply across pairs—but the USD was universally weak.

Stocks & Market Reaction

S&P 500 rose ~0.22% to 6,509.47 by mid-afternoon. Nasdaq added ~0.2%, closing at new highs. Dow Jones advanced ~0.46%. ReutersAP News

Gold hit fresh record highs—spot price around $3,660/oz. Safe-haven flows are real. Reuters+1

Corporate chatter: UnitedHealth rallied 9%; Apple dipped on underwhelming new iPhones; Nebius soared on a major AI deal. AP NewsReuters

Expect volatility—but clients loved the bounce in tape across sectors.

Crypto vs USD

Bitcoin held firm near $111,000 as of 14:14 ET, up slightly on dollar weakness. CoinDesk

Analysis: Weak dollar fuels crypto strength—this is classic Patrick-level contrarian setup. Crypto bulls breathe easier tonight.

Economic Events Recap

Payroll Revision: U.S. job growth slashed by 911,000 jobs—the largest negative revision in memory. Markets were blindsided. AP NewsReuters

Fed-Cut Odds: Markets are now pricing in ~25 bps, with about 10% chance of a 50 bps cut. Reuters+1

Up Next: PPI and Consumer Price Index (CPI) data set to steer the next chapter in USD story.

Christy’s Takeaway & Prediction

This dollar drop isn’t fleeting it’s fundamental, driven by real labor weakness. In my view, we’re entering a fresh risk-on regime: equities, gold, and crypto all rally as liquidity flows shift. That said, tomorrow’s PPI is the fulcrum hot numbers could pause the USD dive; soft ones may spark it further.

Outlook for Tomorrow

Watch PPI closely—its data point could tilt Fed expectations sharply.

EUR/USD may test 1.18 resistance; GBP could flirt with 1.37.

Gold upside remains alive—check $3,700.

Bitcoin: if dollar weakness persists, a breakout toward $115K seems likely.

Equities: more gains if macro momentum persists—but JPM warns “sell the news” risk exists. MarketWatch

FAQ

Q: Why did the dollar tumble so much today?

A: Weak employment data dragged it down—combined with skyrocketing Fed-cut expectations.

Q: Is crypto rallying just because of USD weakness?

A: Partially yes—the dollar drop boosts crypto sentiment. But underlying bullish technicals matter too.

Q: Could we see a reversal soon?

A: Yes—PPI or inflation surprises could flip momentum. Stay disciplined.

Related Articles

Disclaimer: This information is for educational purposes only and is not investment advice.

Sources:

Reuters: Dollar hits seven-week low as jobs gloom heightens Fed cut chances (reuters.com)

Reuters: Sterling firms, Fed cut bets weigh on dollar (reuters.com)

Reuters: Rupee to climb at open after weak jobs (reuters.com)

Reuters: Wall Street ticks toward record, jobs shock (reuters.com)

Reuters: Stocks rise on rate cut bets… (reuters.com)

Reuters: Nasdaq record, AI-driven gains (reuters.com)

Reuters: Gold scales record peak (reuters.com)

Investing.com: Fed cut bets, gold rally (au.investing.com)

CoinDesk: Bitcoin price (~$111,043) (coindesk.com)

Reuters: JPMorgan warns Fed cut could sink stocks (marketwatch.com)