Crypto & Stocks Take the Lead as USD Wobbles

Quick Summary

Bitcoin steady above $113K, inching up ~1.8–2.3% day-over-day.

Ethereum trades near $4.33K, up ~1% as whales accumulate.

S&P 500 & Nasdaq hit intraday record highs; equities surge amid cooling inflation and rate-cut optimism.

Macro pulse: rate-cut bets surge, fueling USD softness and empowering risk assets.

Intro

So here’s the scene: Bitcoin’s clinging above $113K, Ethereum’s sitting around $4.33K, and US equities are smashing records, all while the almighty US dollar shudders under rate-cut euphoria. I’m bullish, contrarian, and brazen here: this isn’t a shaky rally it’s a power play as markets front-run the Fed. Traders, listen up: trends are aligning sharply across crypto and traditional markets. And yeah, my take? This is just the beginning let’s not sleep on the tailwinds.

Crypto vs USD — BTC and ETH

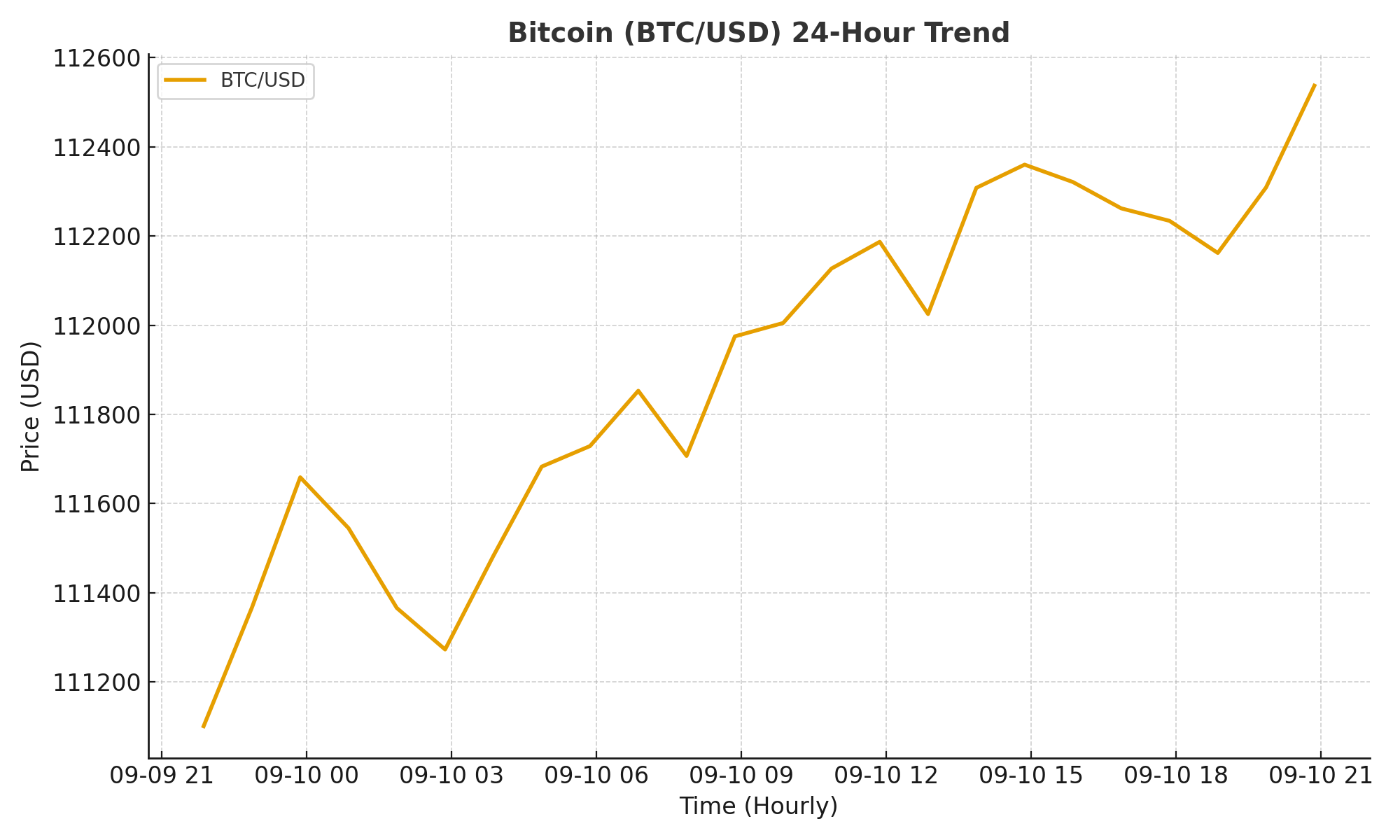

Bitcoin (BTC/USD)

Bitcoin’s hovering at $113K+, rising ~1.8–2.3% in the last 24 hours (TradingView, CoinMarketCap) TradingViewCoinMarketCap. Analysis suggests bull cycles are lengthening and headlines forecasts of $124K and beyond—not yet done reshaping records TradingViewCointelegraph.Ethereum (ETH/USD)

ETH trades near $4.33K, up ~1%–1.1% in 24 hours CoinMarketCapCoinGecko. Whales have scooped up $17 billion worth, tightening supply and amplifying demand—even as ETF outflows of ~$1 billion weigh marginally Trading News. Some models still whisper of an 88% upside on renewed rate-cut certainty Mitrade.

Stocks vs USD — S&P, Nasdaq & Global Equities

The S&P 500 jumped to 6,550.29, +0.58%, and Nasdaq climbed +0.46% to 21,980.60 at open. The Dow added just ~0.04% to 45,731.5 Reuters.

Markets shrugged off inflation scare—Federal Producer Price Index (PPI) came in cool, spurring rate-cut optimism Reuters.

Major names like Oracle powered gains, especially in AI sectors MarketWatch.

Barclays lifted its 2025 S&P 500 target to 6,450 (from 6,050), eyes 7,000 by end-2026—thanks to corporate strength, AI optimism, and expected Fed cuts Reuters.

Patrick’s Prediction

Bullish: Markets are over-discounted on the upside. Crypto's structure, driven by whale buy-ups and speculative cycles, and equities riding AI and rate-cut loyalty—both can keep charging. I believe BTC clears $120K, ETH pushes toward $4.8–5K, and the S&P nears 6,700 by quarter-end. My take: "If inflation whispers, Fed cuts roar—and we’re just hearing echoes."

Why It Matters (for traders/investors)

Traders can ride momentum in crypto while volatility stays surprisingly low.

Equity bulls are powered by rate-cut bets and AI optimism—key for sector plays.

USD softness impacts everything—from commodities to export-sensitive stocks. Watch correlation shifts tightly.

Institutional inflows (like the whale activity in ETH) indicates shifting sentiment—follow the money.

FAQ

Q: Is Bitcoin topping out near current levels?

Nope—not confirmed. Analysts suggest longer bull cycles ahead and potential breakout to $124K—even higher TradingViewCointelegraph.

Q: Why are equities rallying despite cooling inflation?

Markets love surprise hikes in rate-cut odds. Lower consumer pressures = Fed flexibility = markets bid up, especially AI names like Oracle ReutersMarketWatch.

Q: ETH ETF outflows—should that worry me?

Short-term noise. Yes, $1B in ETF outflows raises volume concerns, but whales scooping $17B is a bullish structural cue Trading News.

Related Articles

“Authors to Watch: Patrick Doherty’s Picks”

Sources

Live BTC/USD price: TradingView, CoinMarketCap TradingViewCoinMarketCap

ETH/USD price and whale accumulation: CoinMarketCap, Coingecko, TradingNews CoinMarketCapCoinGeckoTrading News

BTC cycles and forecasts: TradingView, Cointelegraph TradingViewCointelegraph

Equity data: Reuters (S&P/Nasdaq record highs) Reuters

Oracle AI rally: MarketWatch MarketWatch

Barclays S&P targets & commentary: Reuters Reuters