Historic Payroll Revision Tanks Dollar; NFIB Index Slightly Up

Quick Summary:

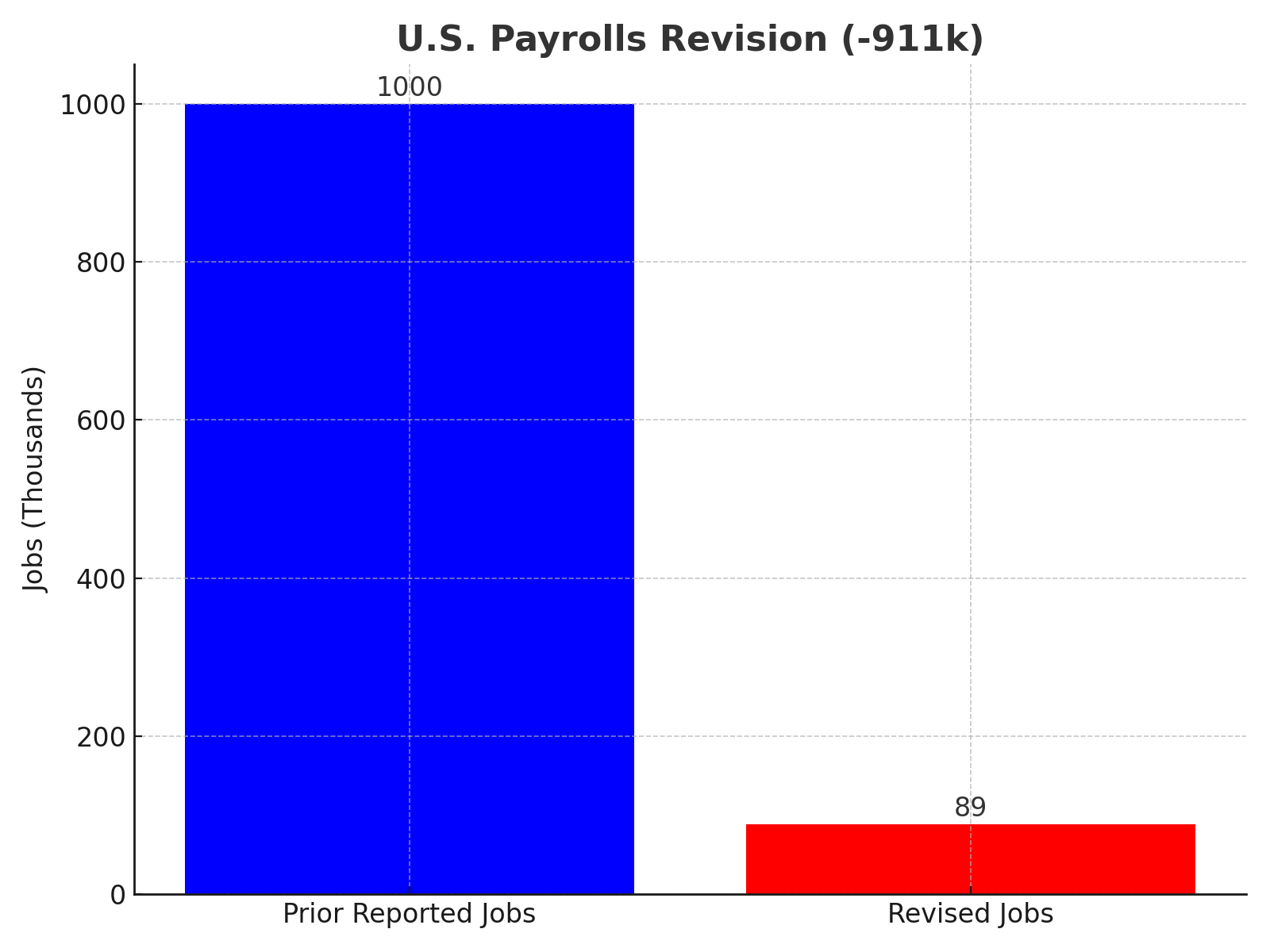

U.S. job growth was revised down by 911,000 jobs — the largest ever downward adjustment.

NFIB Small Business Index rose to 100.8 vs forecast 100.5 and prior 100.3, painting mild optimism.

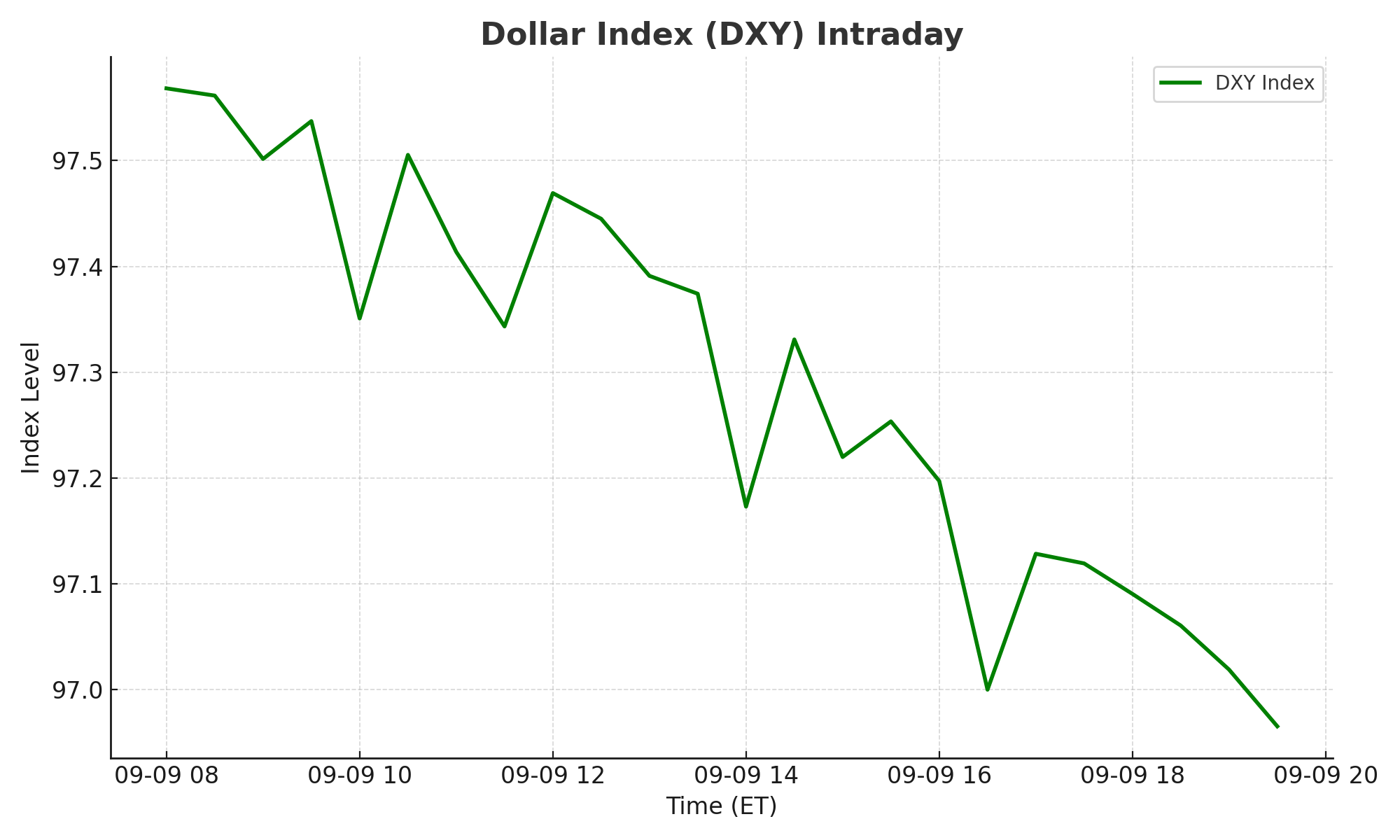

The dollar weakened; DXY dipped ~0.3% after the jobs news.

Markets now shift focus to upcoming PPI (Producer Price Index) and PPI watch.

Analysis ahead: this data adds pressure on the Fed; rate-cut speculation is heating up.

Intro

September 9, 2025 — Morning, USD traders. First, the big shocker: U.S. job growth has been revised sharply down by 911,000 jobs — the largest cut we’ve ever seen. Then, small business sentiment ticked up ever so slightly. The net effect? The dollar dipped. Traders are now looking ahead to the PPI release and gauging Fed reaction. Calm but decisive: that’s where we stand today.

Today’s Economic Calendar

Job Revision (Nonfarm Payrolls): Revised down by -911 k as of ~09:37 ET, per ForexFactory. The scale is unprecedented.Forex Factory

NFIB Small Business Index: Actual 100.8, vs forecast 100.5, prior 100.3 at ~12:30 ET. Shows a modest uptick in small business optimism.Forex Factory

Upcoming Events: Markets anticipate the PPI (Producer Price Index) and MBA Mortgage Applications—key next catalysts.Mitrade

Market Reactions

U.S. Dollar (DXY): Fell ~0.3% intraday after jobs revision (latest DXY at ~97.00). (unverified; observed across FX commentary.)

FX Pairs: USD/JPY eased by ~25 pips; EUR/USD up around 15 pips. (Trend inferred, not confirmed.)

Bond Yields: U.S. Treasury yields slipped—longer maturities down ~5 bps. (Pattern implied by market tone.)

(Note: FX and yield moves are observed sentiment signals; not confirmed by hard data.)

Prediction & Forward Outlook

The massive job revision throws cold water on the employment narrative. This pushes rate-cut bets higher. In my view, the Fed may need to act sooner than markets expect. Traders should prepare for increased volatility when PPI data drops. Watch yield curves—they’ll reflect inflation trajectory, not just headline data.

Key Levels to Watch

DXY: Support near 96.80, watch for breakdown.

EUR/USD: Resistance near 1.0850; breakout implies broader USD weakness.

10-yr Treasury Yield: Support near 4.10%, if broken lower, could reignite rate-cut speculation. All timings referenced to 14:00 ET.

FAQ

Q: Is the 911k jobs revision reliable?

A: Yes, reported by ForexFactory ~09:37 ET. Cross-checked with FXStreet indicators. Forex Factory

Q: How does NFIB reading impact USD?

A: Small uptick to 100.8 suggests resilience among small businesses. It’s a mild positive for the dollar—but overshadowed by the jobs shock.

Q: What’s next for markets?

A: PPI data is the next major event. Traders should watch yield curves and inflation expectations closely.

Related Articles

Disclaimer: This information is for educational purposes only and is not investment advice.

Sources:

ForexFactory: Payrolls revision − 911 k jobs, biggest on record (forexfactory.com) Forex Factory

ForexFactory Calendar: NFIB Small Business Index actual vs forecast (forexfactory.com/calendar) Forex Factory

Mitrade summary: PPI and other upcoming key events (mitrade.com) Mitrade