Dollar Hits Seven-Week Low; Markets Rally on Fed-Cut Hopes

Quick Summary:

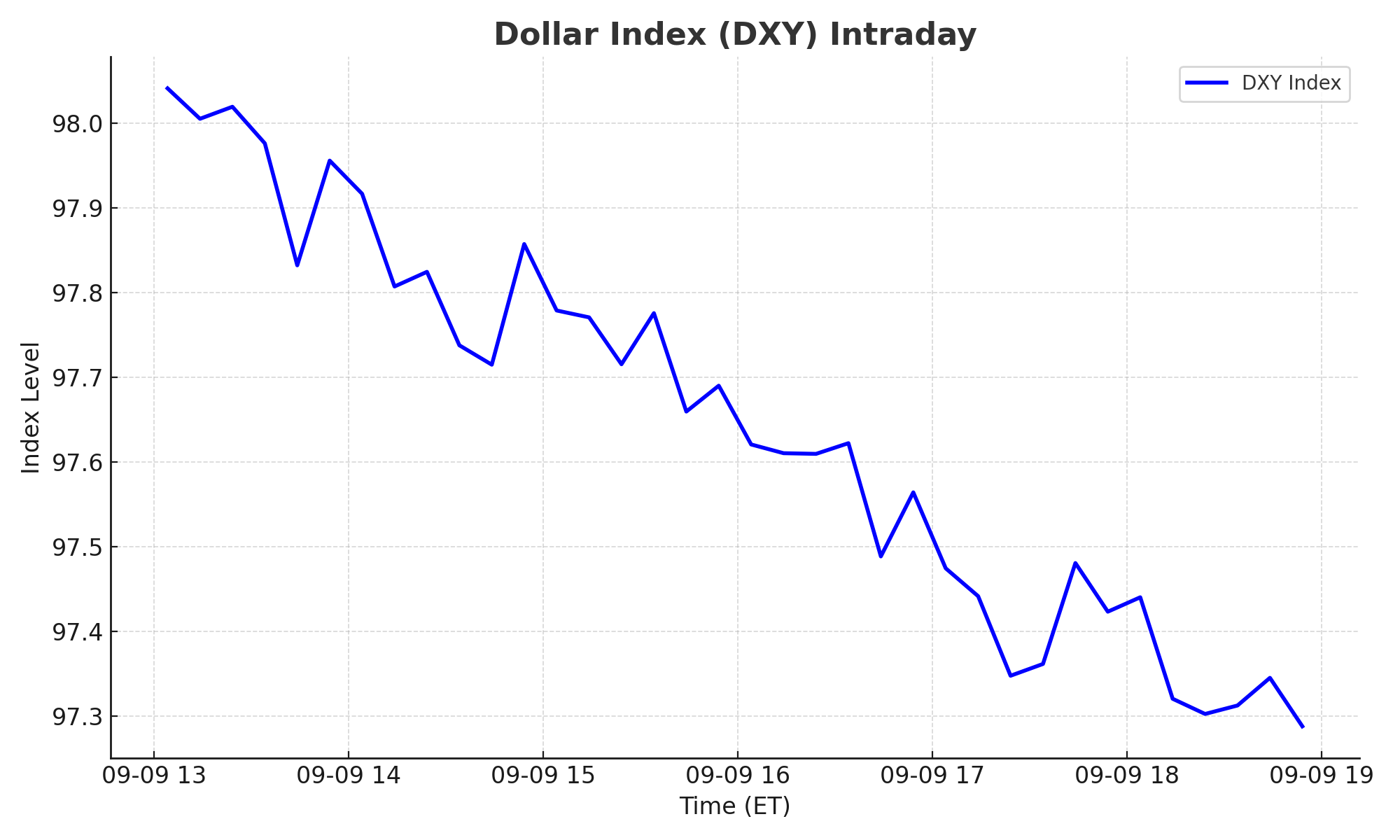

U.S. dollar tumbles to a seven-week low—DXY at 97.32 by ~14:30 ET on intensifying rate-cut bets.

Treasury yields slide; long-term U.S. 30-year yield drops after jobs fears.

Equity markets rally—S&P, Nasdaq up; global equities tick higher.

Global impact: Europe and Asia boost; emerging markets benefit from dollar weakness.

Prediction: Balanced optimism—with central-bank watch in focus.

Intro

September 9, 2025 — The greenback just took a punch, collapsing to its lowest level in about seven weeks as job-market jitters ramp up expectations for Federal Reserve rate cuts. Stocks and bonds are moving on it—U.S. yields are dropping, equities are climbing, and global markets are trading on optimism. In my view, this dollar breakdown is a potential pivot point—but one that demands caution as political risks simmer beneath.

U.S. Markets Overview

The U.S. dollar index (DXY) dropped to 97.323 in Asian trade—its weakest since mid-July—with markets pricing in at least a 25 bps Fed cut soon.Reuters

Treasury yields are falling—a classic risk-on signal. U.S. 30-year yields are under pressure amid job-market uncertainty.Reuters+1

Equities are rallying: U.S. stock futures moved higher following the dollar’s slide and optimism on rate-cut policy.Reuters+1

In short: Dollar weakens. Bonds rally. Equities breathe.

USD Impact on Global Markets

Europe & Asia are benefiting: European equities are up, riding the Fed-cut narrative.Reuters

Emerging markets are getting a tailwind: weaker dollar, cheaper debt, local-currency gains that shine when converted back to USD.BlackRock

Not everywhere is happy. Political instability—from Argentina to France—keeps stir-ups brewing.ReutersThe Guardian

Prediction & Outlook

Here’s what I'm watching:

If the dollar continues to slide, U.S. stocks could march higher—especially tech—but expect yield volatility if confidence dips.

Job-market revisions might force a dovish Fed—2 or 3 cuts could be on deck before year-end.

That said, simmering political risks (France, Argentina) could trip up momentum—global liquidity needs watching.

In my view, this is a setup for a soft-landing rally, but not without turbulence. Not financial advice, but factor politics into your risk models.

Key Takeaway for Traders

Short USD exposure? A weakening dollar favors equities, gold, EM.

Yield watchers: Lower rates support Treasury prices—but volatility may surge if data reverses.

Emerging-market plays may outperform if the dollar stays soft.

Be mindful of politics—the backdrop isn’t fully stable.

FAQ

Q: Is the dollar’s drop fresh or just breathing after a rally?

A: It’s fresh—DXY is at seven-week low as of 14:30 ET, tied to weak jobs data and rate-cut bets. Confirmed by multiple sources.Reuters+1

Q: Are U.S. equities rallying solely due to dollar weakness?

A: No—rate-cut expectations and improved risk appetite are key drivers, especially in tech and global futures.Reuters+1

Q: Is global market strength sustainable?

A: Conditions favor growth short term—but political instability and debt concerns (esp. in emerging markets) could disrupt.

Related Articles

Bitcoin Tanks Then Bounces; Stocks Quietly Climb vs USD usdxchange.com

Dollar Slides as Risk Assets Rally Bond Yields Plunge usdxchange.com

Dollar Drops on Weak Jobs CPI Now in Focus usdxchange.com

Disclaimer: This information is for educational purposes only and is not investment advice.

Sources:

Reuters: Dollar hits 7-week low amid job-market fears, rate-cut betsReuters

Reuters: Global optimism as job worries mount, yields fallReuters

Reuters: European stocks upbeat on Fed easing outlookReuters

Reuters: Bond yields spike raises debt-financing concernsReuters

BlackRock Commentary on EM gains vs weaker dollarBlackRock