Dollar Slides Across the Board as Fed Easing Whisper Swells

Quick Summary

USD falls ~0.5 percent vs EUR and GBP, ~0.7 percent vs JPY at 09:00 ET

EUR/USD up from ~1.1650 to ~1.1710; GBP/USD from ~1.3430 to ~1.3505 ReutersInvesting.com

USD/JPY dips from ~148 to ~147.4 Investing.com

Market bets on Fed rate cuts strengthen on weak jobs data Reuters

Traders eye CPI and inflation data this week for the next USD move

Intro

What a gentle tumble for the greenback this morning—no drama, just steady softness. The euro and pound added half a percent or so, the yen accounted for almost a 0.7 percent gain. All this on whispers of Fed easing growing louder after weak US labor numbers. It’s a classic mild breath out after a sprint. Fed watchers, pay attention — inflation clues ahead could steer the next wave.

Major Currency Pairs

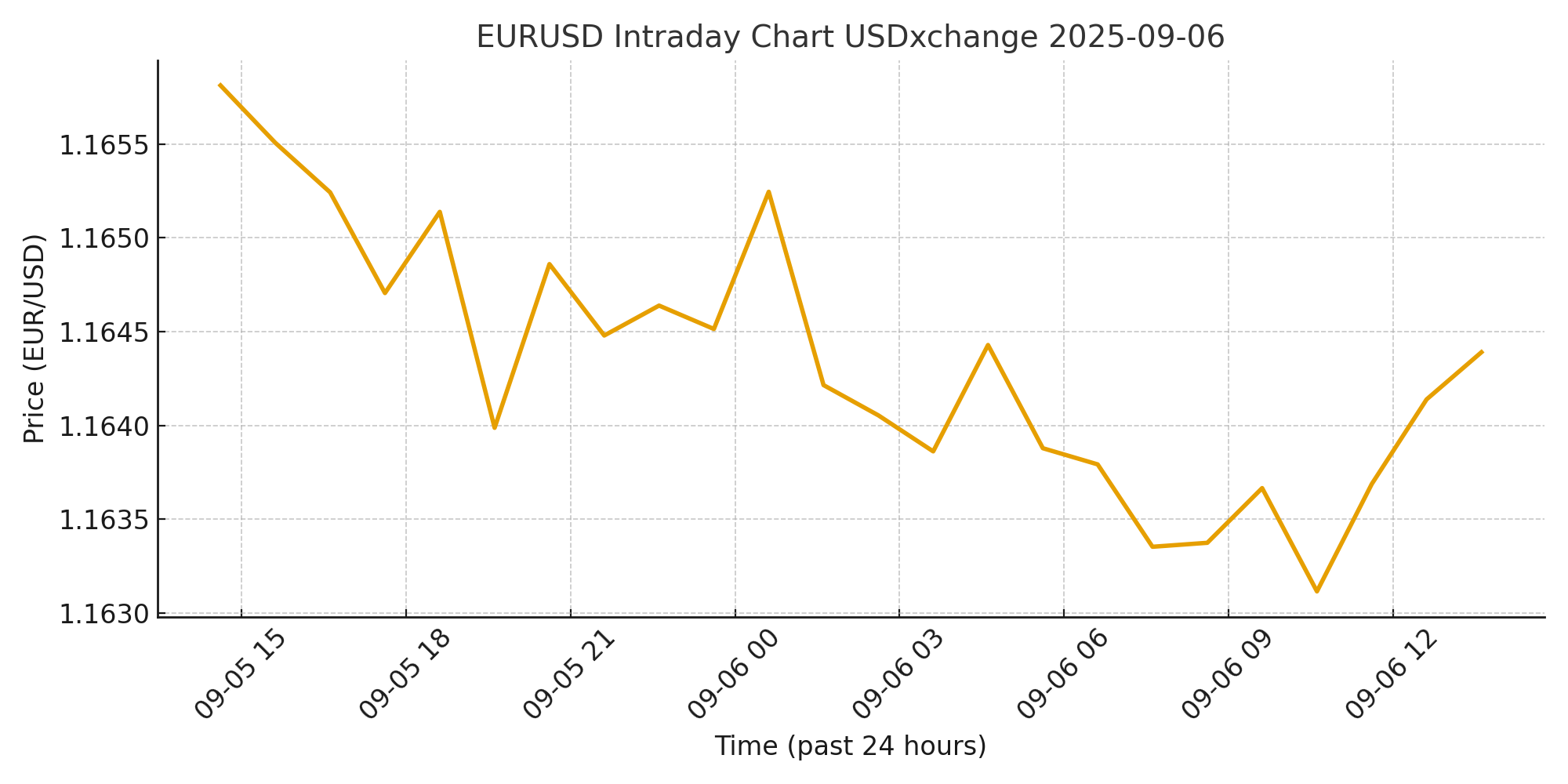

EUR/USD

Traded from about 1.1650 to 1.1710 by 09:00 ET, a ~0.5 percent rise ReutersInvesting.com.

Reason: dollar weakness and higher rate cut odds.

GBP/USD

Moved from ~1.3430 to ~1.3505 (~0.55 percent gain) Investing.com+1.

Pound riding dollar softness amid Fed cut chatter.

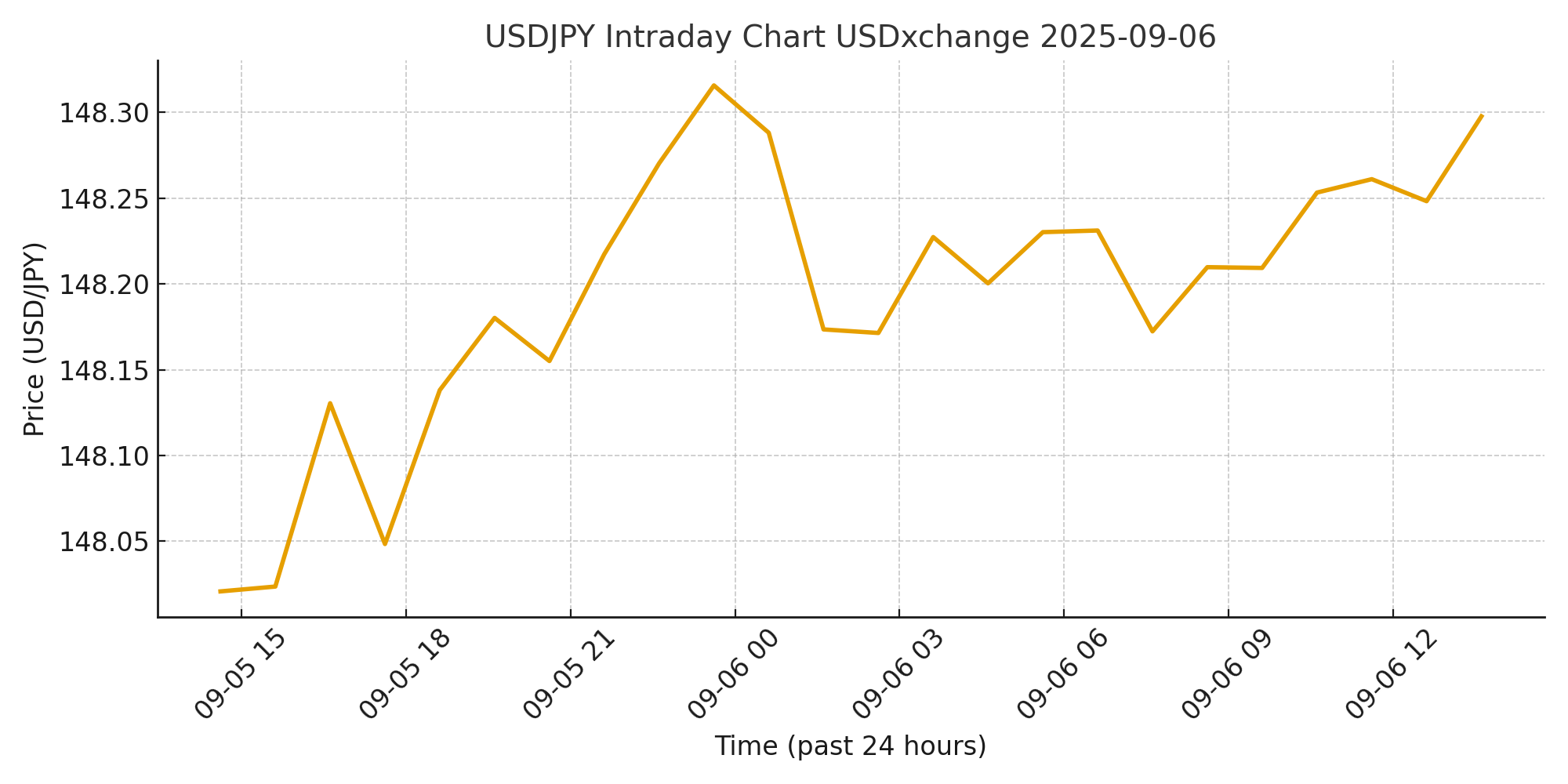

USD/JPY

Fell approximately 0.7 percent from ~148.1 to ~147.4 Investing.com.

Political uncertainty in Japan adds caution, but yen benefits as dollar softens.

Macro Drivers

Weak US jobs data shook markets — Fed cut odds are heating up Reuters+1.

Traders are now looking ahead to US inflation and Fed commentary as next triggers.

24–48 Hour Forecast (Opinion)

Expect more testing of resistance levels on EUR/USD and GBP/USD if the dollar remains weak. If US CPI undershoots, we could see EUR/USD push above 1.1750 and USD/JPY slip toward 146.50. A surprise hawkish turn from Fed officials would snap dollar weakness, but that doesn’t look likely just yet.

(This is Masha’s analysis, not financial advice.)

Practical Impact for Traders

EUR/USD: Watch 1.1710 support, 1.1750 resistance.

GBP/USD: 1.3500 key level — break higher if momentum holds.

USD/JPY: 147.50 support; a move below opens range to 146.50.

Keep one eye on US inflation expectations and scheduled Fed speaker comments.

FAQ

Q: Why is USD underperforming across pairs today?

A: Recent weak jobs data pushed rate cut expectations higher, easing pressure on the dollar.

Q: Should traders jump into long EUR/USD now?

A: Only after confirming a push above 1.1710 — price action will tell the story.

Related Articles

Economic Calendar

News

Authors

Sources

EUR/USD, GBP/USD, USD/JPY moves from live rates via Reuters LSEG data and Investing.com streaming rates ReutersInvesting.com

Fed cut odds boosted by weak jobs data via Reuters and Reuters follow up Reuters+1

USD/JPY outlook and yen context via Reuters political analysis (indirectly) and pair data above (see rates)