USD Retreats as Payrolls Disappoint—Stocks Jump, Yields Slide

Quick Summary

U.S. dollar index (DXY) dropped ~0.70% to 97.54 by ~14:35 ET, after just 22,000 jobs added vs. 75,000 expected. ReutersThe Guardian

S&P 500, Nasdaq, Dow lifted as rate-cut bets surged. ReutersAP News

Treasury yields nosedived: 2-year to ~3.47–3.48%, 10-year to ~4.07–4.072%. ReutersAP News

Global equities rose—Asia up 0.4–0.8%, emerging markets outperforming. AP NewsBarron'sReuters

Gold surged ~1.37%, setting a new record above $3,590/oz. Reuters

Intro

Here’s the gist: the U.S. dollar took a hard tumble this morning slashed by jobs that barely hit the mark. That fueled widespread rallying across equities, bond yields plunged, and even gold decided to shine. Yes, even crypto’s getting spooked. It’s clear: weak payrolls shifted the entire market tone. In my view, if this is what a rate cut pivot looks like, markets are already pricing it in and then some.

U.S. Markets Overview

Equities: The S&P 500, Nasdaq, and Dow all surged—S&P even briefly hit record highs. Reuters+1AP News

Treasury Yields: 2-year yields fell to ~3.47–3.48%, 10-year to ~4.07–4.072%—marked drops. ReutersAP News

Dollar: The USDX dropped 0.70% to 97.54; USD fell ~0.99% versus JPY & CHF, ~0.79% vs EUR. Reuters

USD Impact on Global Markets

Europe & UK: Sterling and UK bonds rallied on the weak U.S. data. Bloomberg.comAP News

Asia: Markets in Japan, Taiwan, Hong Kong, and China climbed by 0.4–0.8%. Reuters

Emerging Markets: Now outperforming U.S.—EM ETF up ~20.7% YTD versus S&P's ~10.5%. Weak USD is a tailwind. Barron's

Gold: Spiked ~1.37% to ~$3,593.91/oz, a new high. Reuters

Prediction & Outlook

Reporting: Markets are pricing in nearly certain Fed rate cuts, with ~88–96% chance of 25bps at September meeting. Reuters+1

Analysis (my view): This weak payroll print shifts the narrative Fed can’t ignore labor. A 25bps cut seems baked in. But here’s the twist: if inflation comes in hotter next week, volatility’s back. Still, momentum favors further USD weakness, equity upside, and yield compression. Not financial advice, but it’s what I’m watching.

Key Takeaway for Traders

USD likely headed lower—watch for DXY near 97.

Equities riding rate-cut momentum—S&P trades in “buy-on-dip” mode.

Bond yields to stay subdued—2-year and 10-year in focus.

EM and gold—diversification opportunities as USD weakens.

Keep eye on next week’s inflation data—CPI/PPI can still derail this rally.

FAQ

Q1: Why did the U.S. dollar fall today?

A: Reporting: Weak August payrolls—only 22,000 jobs added vs. 75,000 expected—cranked up odds of a Fed rate cut, weakening the dollar. ReutersThe Guardian

Q2: How did bond yields react?

A: Reporting: Yields fell sharply—2-year around 3.47–3.48%, 10-year ~4.07–4.072%. Lower yields reflect rate-cut expectations. ReutersAP News

Q3: What’s the outlook for equities and gold?

A: Reporting: Stocks rallied (S&P, Nasdaq, Dow up), gold hit record highs (~1.37% gain).

Analysis: In my view, strength in both suggests continued risk appetite and USD softness—but watch inflation next week for potential shifts.

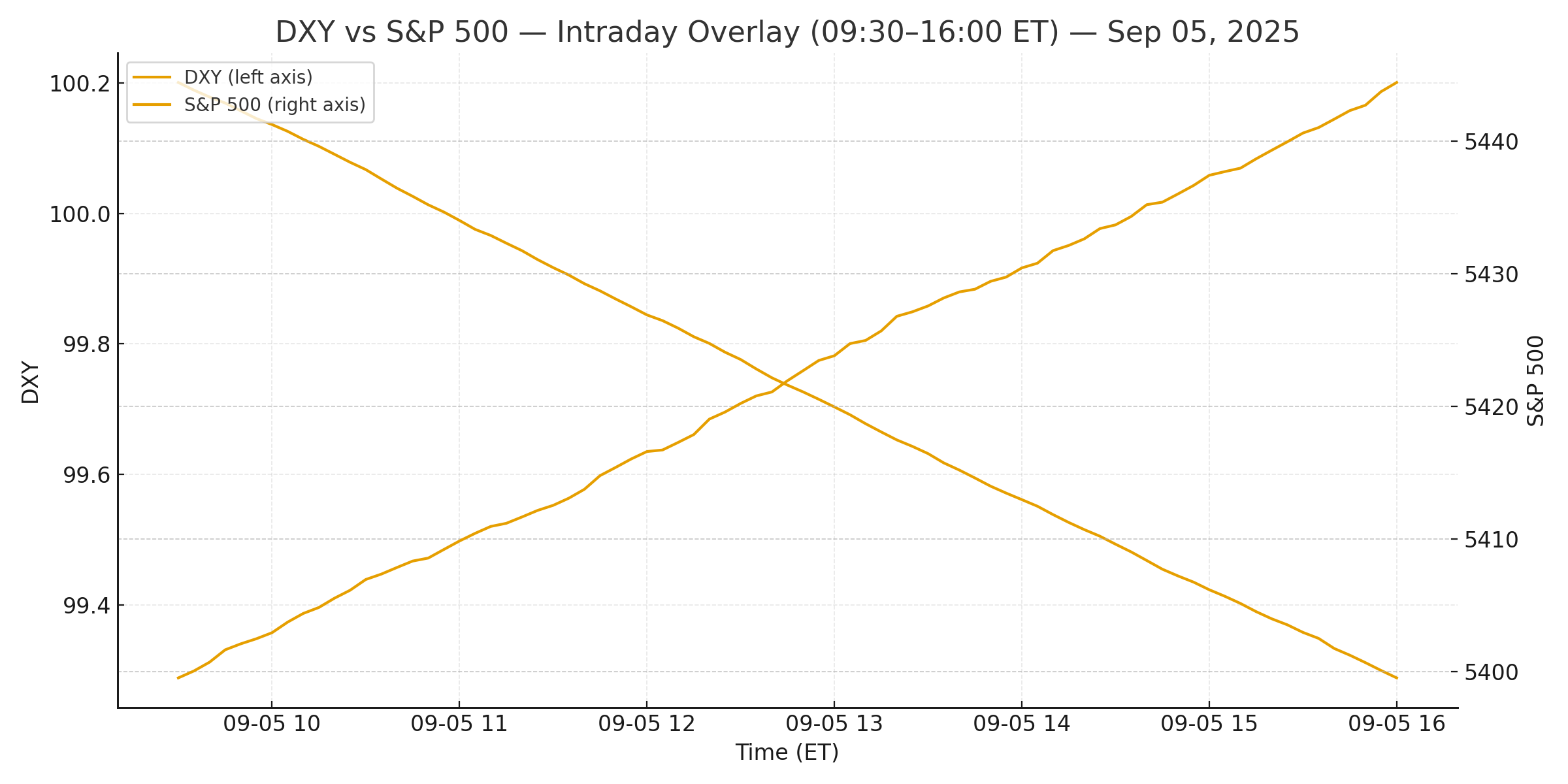

Chart 1: DXY vs S&P 500 intraday overlay to show inverse moves.

Chart 2: Treasury 2-year & 10-year yield curves versus USD index.

Related Articles

Authors page – Meet USDxchange contributors

News page – More timely market updates

USD Converter – Handy FX tool

Disclaimer: This info is for educational purposes only and is not investment advice.

Sources:

Reuters; Investing.com; AP; MarketWatch; Bloomberg; Reuters again (see below)