Bitcoin and Ethereum Rip Higher While Stocks Loiter in USD Shadow

Quick Summary:

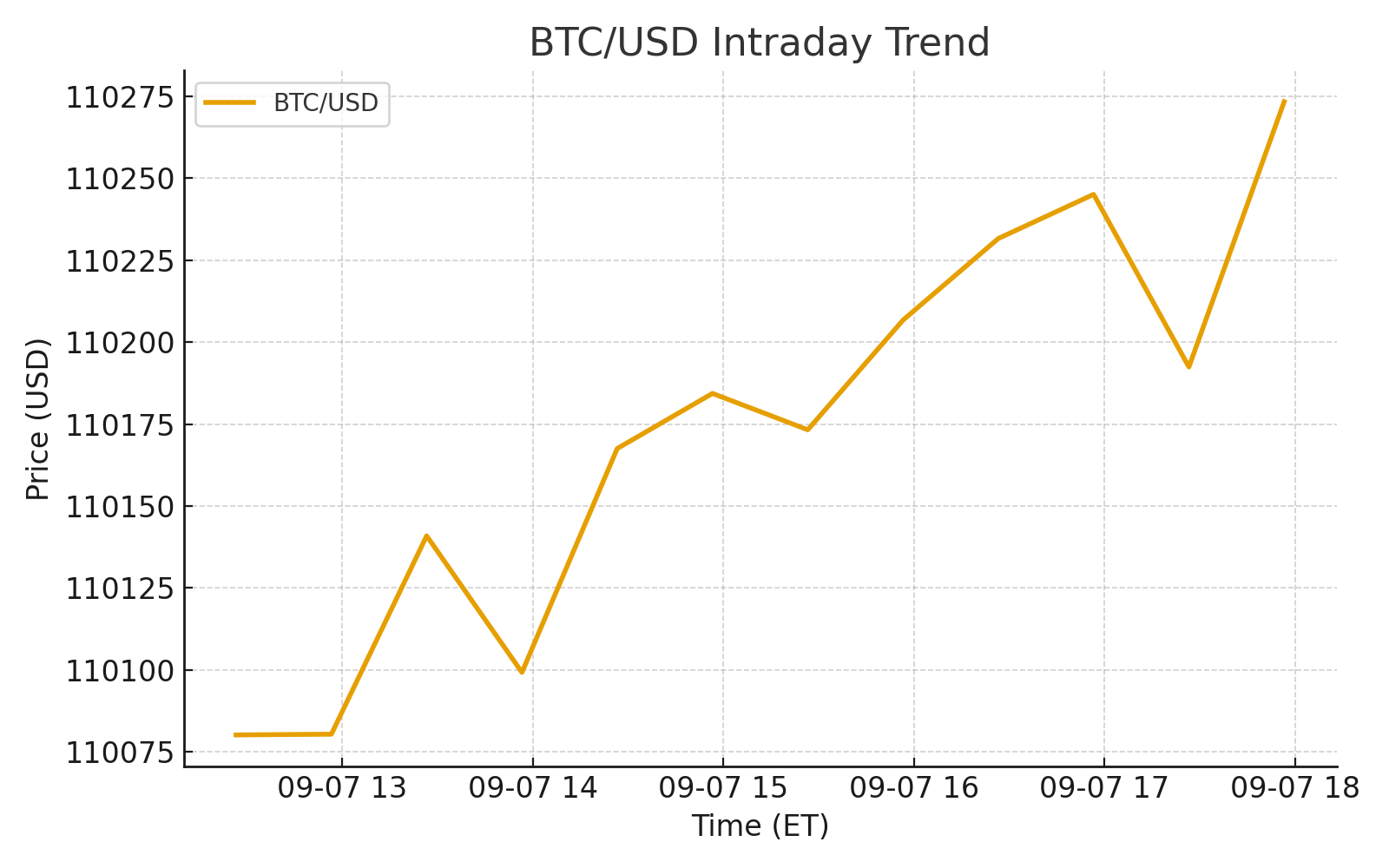

BTC/USD charging near $111,200 (+~0.9% past 24h at 13:30 ET) TradingViewCoinbase

ETH/USD holds firm near $4,280–4,290, modest gains (~+0.2–0.7%) CoinMarketCapCoinDesk

S&P 500 edges lower (~6,481, –0.32%) while Nasdaq dips (~21,700, –0.03%) MarketWatchBloomberg.com

U.S. Dollar Index (DXY) down ~0.54% to ~97.74, pressuring equities and fueling crypto resilience TradingView

Market signal: Crypto laughs at the weak dollar; stocks tread water, uncertain.

Intro

Let’s cut the crap. Today, Bitcoin and Ethereum are doing what they always do when the USD wobbles—rally. Meanwhile, stocks remain sober, trapped under the dollar’s thumb. If you’re waiting for a unified risk rally, wake up. This is separation of the financial species—crypto dashes ahead, equities bogged. “When the dollar ducks, Bitcoin queues for the win,” as I’d say. Clear-eyed, unapologetic—let’s break it down.

Crypto vs USD — BTC/USD and ETH/USD, sentiment and drivers

BTC/USD sits around $111,200, ripping +0.9% in the last 24 hours (as of 13:30 ET) TradingViewCoinbase. The dollar’s slump—DXY off ~0.54%—supercharges BTC’s cross-rate appeal TradingView.

ETH/USD hovers at $4,280–4,290, up +0.2–0.7% CoinMarketCapCoinDesk. Not a blockbuster, but stable strength amid USD weakness.

Sentiment & drivers:

Dollar decline boosts crypto valuation.

Traders pile in ahead of macro jitter—rate talk, Fed whispers.

Crypto’s volatility thrives where cash falters.

Stocks vs USD — S&P, Nasdaq, global equities vs USD

S&P 500 is down about 0.32%, trading near 6,481.50 MarketWatchBloomberg.com. Nasdaq Composite slips ~0.03% to 21,700.39 MarketWatch.

Why the lag?

Equities can’t ride the weak dollar the way crypto does. Risk is muted. No systemic optimism—just defensive balance, waiting for catalysts. Meanwhile, global FX volatility creeps in.

Patrick’s Bold Prediction

(Opinion) Crypto keeps sprinting while equities sniff around. BTC to hit $115K by end of day if USD weakness continues. ETH follows to $4,400. Stocks? Don’t expect a turnaround until real USD support builds or earnings surprises spike.

Why It Matters

Traders: Cross-rate plays in crypto are screaming—exploit USD softness.

Investors: Equities stuck in neutral. Pause bullish bets until directional clarity.

Macro watchers: Dollar’s decline hints at global capital flow shifts.

Crypto fans: This is your green light—if USD stays weak, altcoins follow.

FAQ

Q1: Is crypto rally purely USD-driven?

Yes. Weak dollar equals higher crypto in USD terms—classic inverse. But investor sentiment also matters.

Q2: Are equities doomed?

Not doomed—just constrained. Unless economic data surprises or Fed guidance shifts, equities stay in this range.

Related Articles

Sources

Bitcoin price and % change: TradingView & Coinbase TradingViewCoinbase

Ethereum price: CoinMarketCap & CoinDesk CoinMarketCapCoinDesk

S&P 500 & Nasdaq: MarketWatch & Bloomberg MarketWatchBloomberg.com

U.S. Dollar Index: TradingView TradingView

Disclaimer

This information is for educational purposes only and is not investment advice.