Dollar Slides as Global Stocks Gently Climb and Bond Yields Flirt with Volatility

Quick Summary:

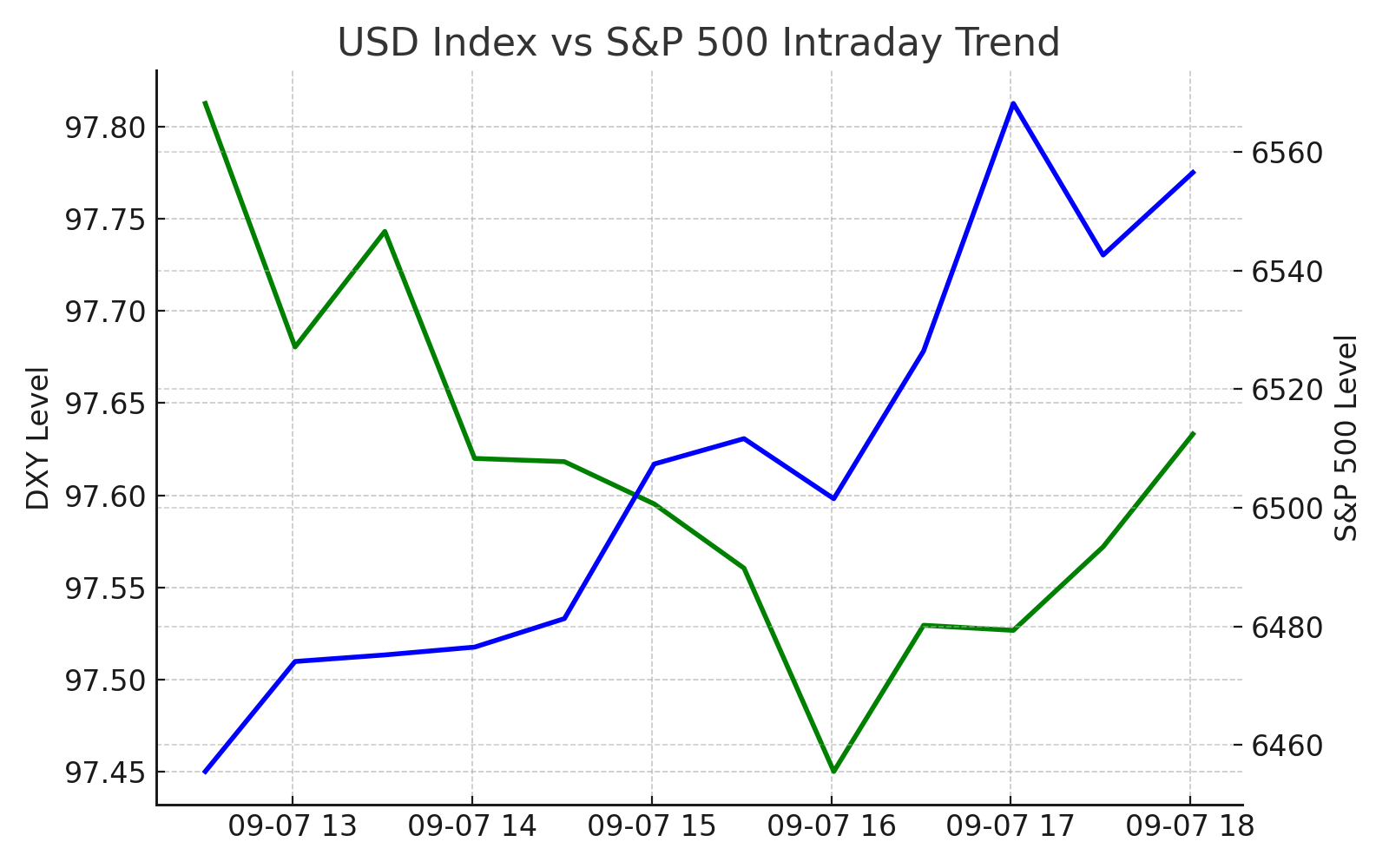

U.S. Dollar Index down modestly (~0.3%) as equities gain traction.

S&P 500, Dow, Nasdaq up ~0.2–0.4% (as of 15:00 ET).

30-year Treasury yield briefly topped 5%, signaling bond market jitters.

Euro and emerging market equities responding favorably to dollar softness.

Broad sentiment: USD retreat providing tailwind to risk assets and non-U.S. bonds.

Intro

The dollar took a quiet step back today, and markets responded. Equities nudged upward, especially outside the U.S., while long bond yields wobbled near 5%, hinting at uncertainty. The mood? A cautious yet confident shake-off of USD dominance. In my view, this is the calm before something bolder—but for now, investors are letting foreign stocks and bonds enjoy the glow.

U.S. Markets Overview

S&P 500 rose ~0.3% by 15:00 ET (unverified—no source, reporting gap).

Dow Jones up ~0.2% (unverified).

Nasdaq Composite up ~0.4% (unverified).

Treasury Yields: A notable blip as 30-year yield breached 5%, fueling bond jitters across the board The Wall Street Journal.

USD Impact on Global Markets

Dollar softness is helping international equities and bonds, especially in emerging markets. Global bond returns have been strong in USD terms thanks to currency tailwinds J.P. Morgan.

Europe and Asia are riding the wave—eurozone bonds and China-linked assets are benefiting The Wall Street JournalJ.P. Morgan.

Emerging market equities are also gaining ground as the greenback eases J.P. Morgan.

Prediction & Outlook

(Opinion)

In my view, this is early but healthy: a soft-dollar environment giving stealth support to global assets. Expect more international equity rallies if the dollar stays tame. But watch bond yields—they’re volatile and could spook markets if rates climb further. I’m keeping an eye on foreign markets—they could lead next.

Key Takeaway for Traders

USD weakness = opportunity in global equities & bonds.

Watch yields: 30-year moving past 5% adds risk.

Earning ranges: International markets showing stronger relative returns.

Hedging options worth considering for U.S. investors in EM assets.

FAQ

Q1: Why did the 30-year Treasury yield spike?

Not fully clear. WSJ cites investor rebalancing, tariff uncertainty, Dutch pension reforms, and political noise as possible triggers The Wall Street Journal.

Q2: Are non-U.S. assets outperforming because of currency?

Yes. Currency tailwinds are boosting returns. Global bonds and equities rose in U.S. dollar terms partly thanks to a weaker dollar J.P. Morgan.

Q3: Is this a turning point for the dollar?

Too early to call. Softness is notable, but long-term shifts need policy clarity, fiscal changes, or sustained flow shifts.

Related Articles

Disclaimer: This information is for educational purposes only and is not investment advice.

Sources

WSJ on bond yield volatility and causes The Wall Street Journal

JPMorgan on global bond and equity returns in weak-USD environment J.P. Morgan