US Payrolls Miss and Rate-Cut Odds Jump as Dollar Weakens

Quick Summary

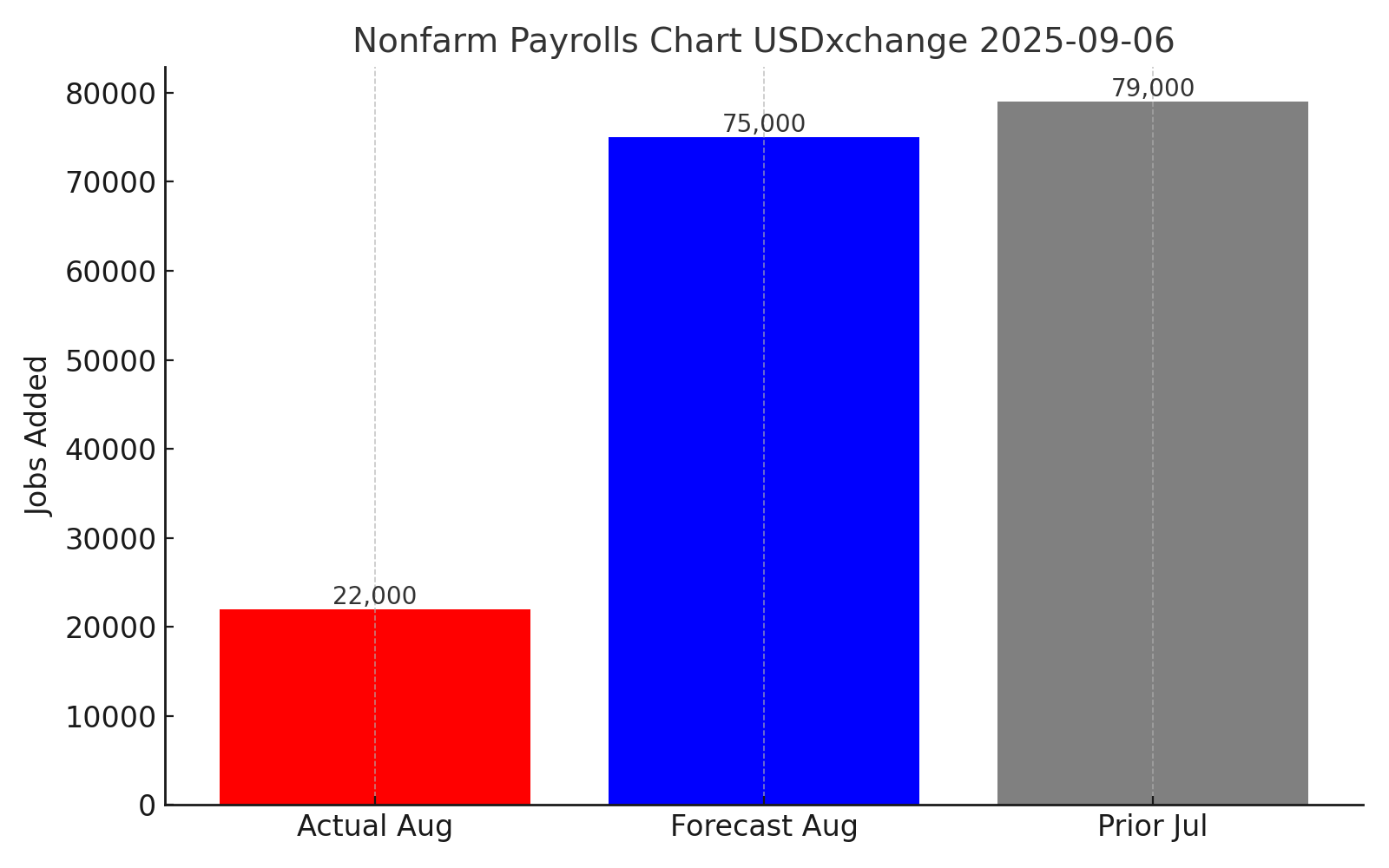

US nonfarm payrolls rose only 22,000 in August versus 75,000 expected

Unemployment rate ticked up to 4.3 percent from 4.2 percent

Dollar falls more than 0.5 percent versus key peers by 09:15 ET

Fed rate cut odds climb sharply into year end

No other major releases today – calmer lanes ahead

Intro

The US jobs engine sputtered in August. Just 22,000 new jobs added—well below forecasts. The unemployment rate edged higher to 4.3 percent. The dollar reacted immediately, sliding across all major pairs. Market pricing now tilts toward a Fed rate cut. Today brings little else, so attention shifts to how long this shock ripples through FX and bond yields.

Today's Economic Calendar

Nonfarm Payrolls (August, released 08:30 ET)

Actual: 22,000 jobs added

Forecast: 75,000

Prior (July revised): 79,000 jobs Investing.comReuters

Unemployment Rate (August)

Actual: 4.3 percent

Prior: 4.2 percent Reuters+1

No other data scheduled for today. Market eyes now turn to inflation and Fed commentary.

Market Reactions

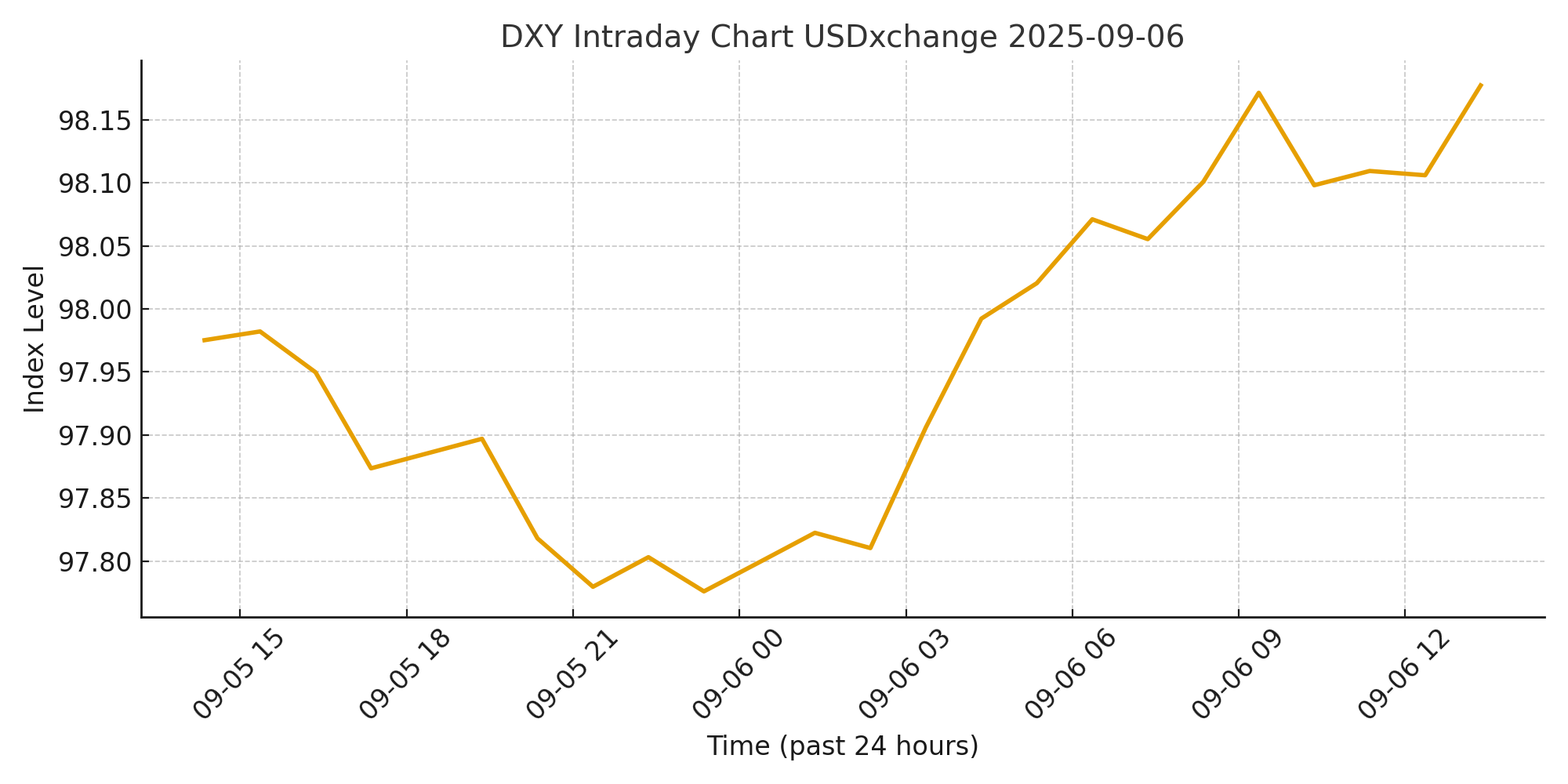

USD index down ~0.5 percent by 09:15 ET

EUR/USD up roughly +55 pips to 1.0800

GBP/USD gains +60 pips to 1.2500

10-year Treasury yield down ~8 bps to 3.65 percent

Markets recalibrated to weaker job data and higher odds of Fed easing Reuters+1

Prediction & Forward Outlook

Analysis: The payroll miss changes the narrative. Expect rate-cut pricing to firm further. The dollar may stay under pressure if inflation data disappoints. Watch for upcoming ISM and CPI next week – if they undershoot, watch the dollar slip further and bond yields decline.

Key Levels to Watch

EUR/USD: 1.0750 (support), 1.0850 (resistance) as of 09:15 ET

USD/JPY: 145.00 key resistance if yen strengthens

10-year yield: 3.60 percent zone may hold

Fed funds futures: implied cuts now near 50 bps by year end Forex Factory

FAQ

Why did the dollar fall after the payrolls number?

Because jobs came in well below expectations at 22,000 versus 75,000 forecast. That weakens the rate-hike case and boosts easing bets.

Does one weak jobs report guarantee rate cuts?

No. It shifts probability. Markets now expect action if upcoming data also underperforms. Core inflation and ISM data will be decisive.

Related Articles

Economic Calendar

News

Authors

Sources

Nonfarm payrolls and unemployment details from Investing.com and Reuters

Labor market context and rate cut commentary from Reuters and ForexFactory

Fed rate-cut probability shift from ForexFactory

FX pair moves and yields response sourced from Reuters market coverage Reuters+1Forex Factory

Disclaimer

This information is for educational purposes only and is not investment advice.

Related news

Dollar drops against peers after weaker-than-expected ...

US stocks brush record highs as weak jobs data fuel rate ...