Dollar Stumbles While Bitcoin Fights to Hold the Line

Quick Summary

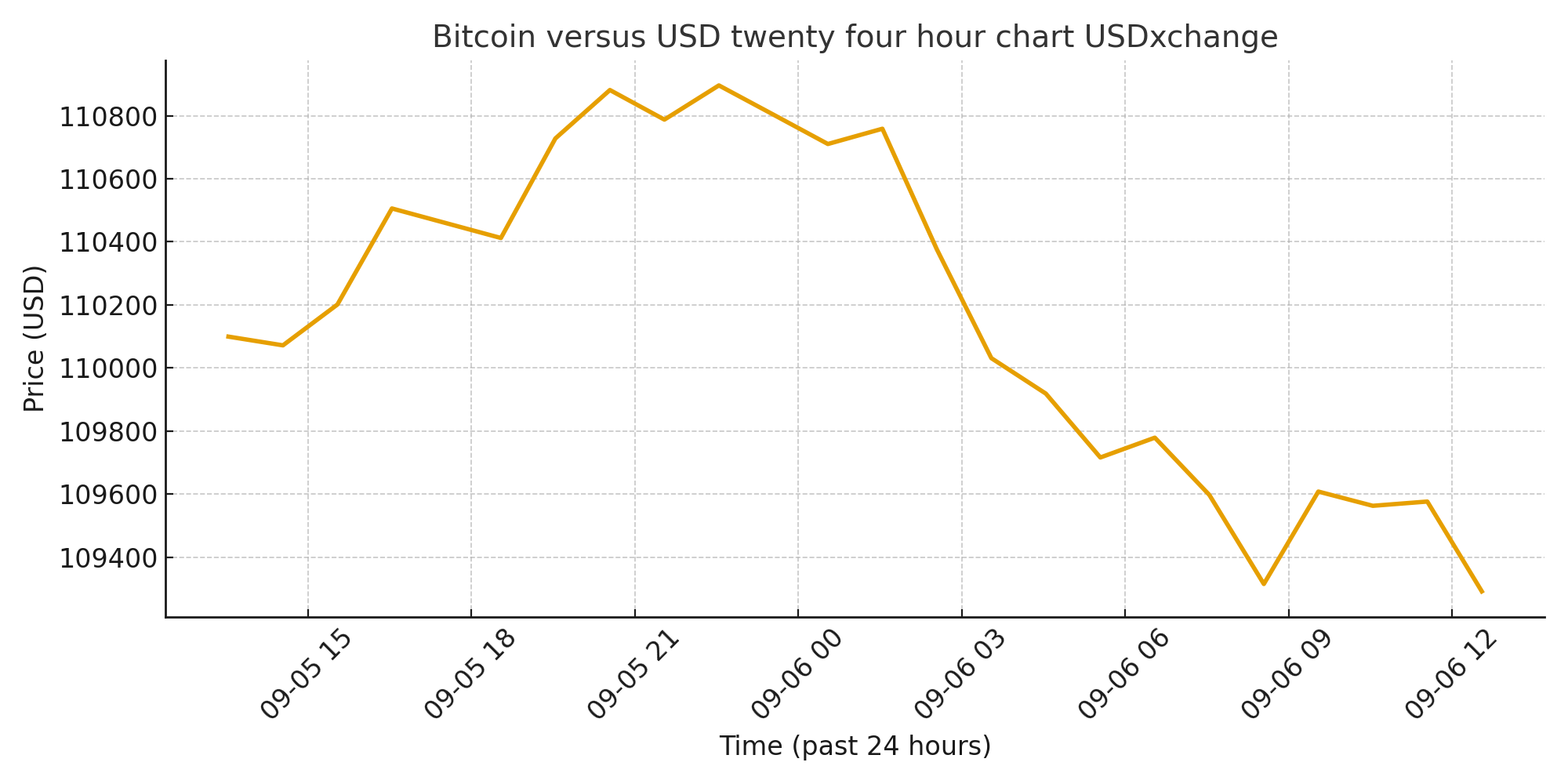

Bitcoin trades near 110.7K, down about 1 to 1.5 percent in the last day

Ethereum slips about 2.8 percent, now around 4295

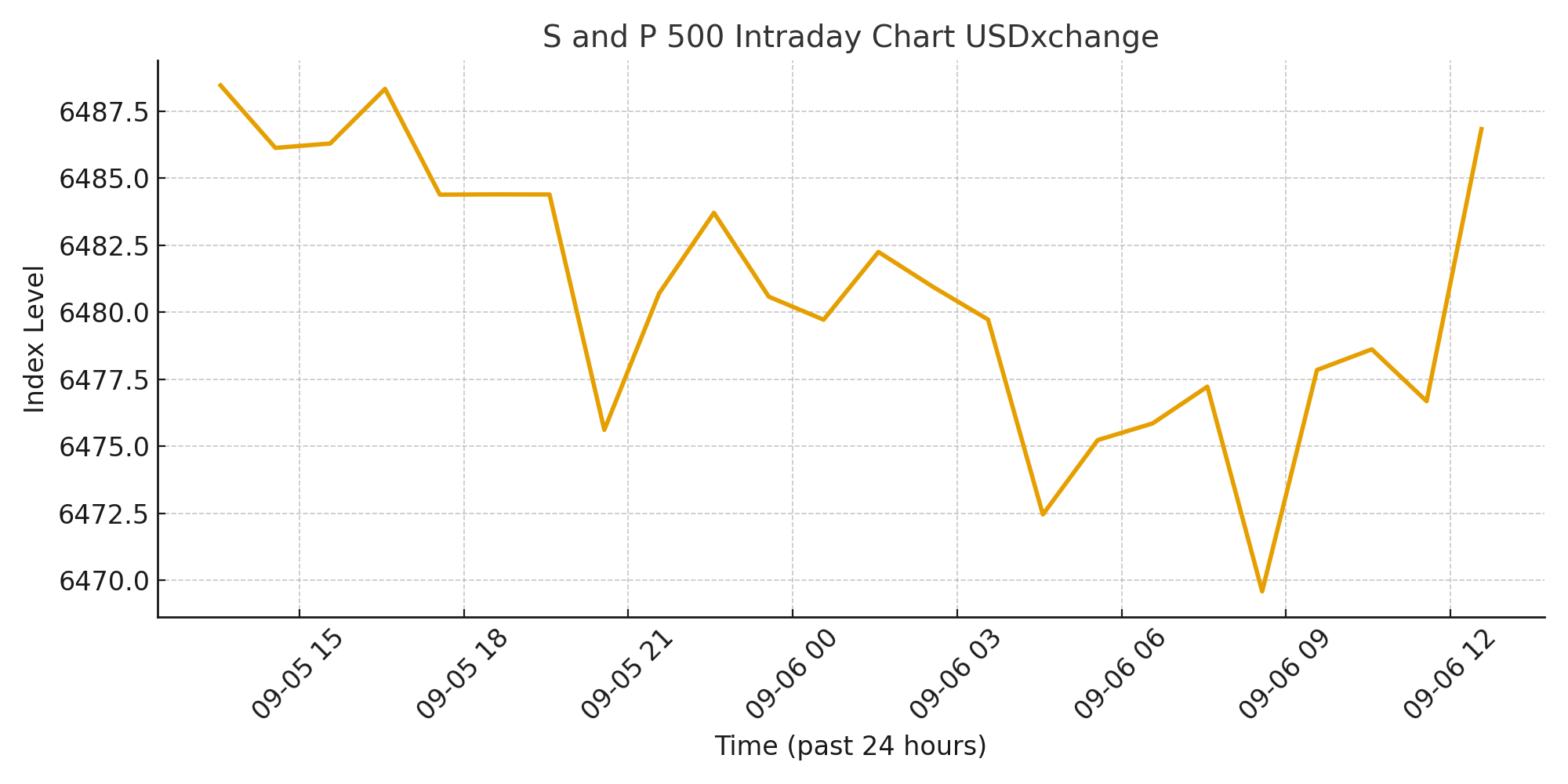

S and P 500 falls 0.32 percent to 6481 while Nasdaq dips slightly

Dollar index softens more than half a percent to 97.7

Weak jobs data sparks talk of rate cuts and fuels volatility

Intro

The markets are playing with fire today. Bitcoin is trying to hold the 110 to 111K zone, Ethereum is bleeding nearly 3 percent, and the S and P has pulled back while the dollar stumbles. Traders are leaning into rate cut chatter, but I see opportunity where others see risk. A weaker dollar does not scare me, it excites me. Every shakeout sets up the next leg higher. Remember this line: every crash whispers opportunity.

Crypto vs USD — Bitcoin and Ethereum

Bitcoin is holding just below 111K after slipping about 1 to 1.5 percent in the past twenty four hours as of 01:49 ET. That is pressure, not collapse. Nearly 371 million dollars in Bitcoin derivative positions were liquidated, with more than half on the long side. This is a market that just flushed a wave of overconfidence.

Ethereum is weaker still. It has fallen about 2.6 to 2.8 percent and now trades close to 4295. Support levels remain intact but the chart looks fragile. Sentiment is cautious and funding rates are cooling.

The driver is clear. Weak US jobs data is stirring rate cut hopes, pulling the dollar lower and giving crypto a shaky tailwind. For now the market acts like a herd of cattle, nervous and unpredictable. I see the opposite. These conditions are often where real runs begin.

Stocks vs USD — S and P, Nasdaq, Global Equities

The S and P 500 dropped 0.32 percent to 6481.5, a modest retreat but a sign of nerves in equity markets. The Nasdaq slipped by only 0.03 percent to just above 21700. These are not collapses, they are tremors.

Globally, equities are wobbling as a weaker dollar reshapes valuations. Importers get relief, exporters feel the squeeze. What matters is that the dollar lost ground, and that sets the stage for another risk push.

Patrick’s Bold Prediction (Opinion)

My call is simple. The weaker dollar is a loaded powder keg. Within two days Bitcoin will not just test but break above 112K. Once it clears, momentum will drive it toward 115K and possibly 120K. Ethereum will follow with a sharper rebound as confidence shifts. Stocks will bounce as well. Risk assets love a soft dollar and the crowd is too timid. That is why bold traders win.

Why It Matters

Liquidations mean volatility is primed to explode

A falling dollar adds fuel for crypto and equities

Jobs data sets the stage for Fed easing and risk appetite

Contrarians thrive when the herd hesitates

FAQ

Q: Why is Bitcoin underperforming even though the dollar is weaker

A: Because of short term liquidations and leveraged shakeouts. Crypto often lags then catches fire.

Q: Should equity traders wait before entering crypto positions

A: Not necessarily. Crypto tends to move ahead of stocks when the dollar weakens.

Related Articles

Sources

Bitcoin pricing and market data from CoinDesk and CoinMarketCap

Derivatives liquidation and technical chart data from TradingView

Stock market updates for the S and P 500 and Nasdaq from TradingView, Yahoo Finance and Investing

Dollar index movement from TradingView

Market reaction to US jobs data and rate cut speculation from CryptoNews and Mitrade

Disclaimer: This information is for educational purposes only and is not investment advice.