PPI Dips 0.1% – Dollar Wobbles, Markets Adjust

Quick Summary

U.S. Producer Price Index (PPI) fell 0.1% in August, versus a +0.3% consensus, signaling cooling wholesale inflation.

Services PPI led the drop, sliding 0.2%, while goods PPI edged up 0.1% (5:00 ET).

U.S. dollar eased modestly—Euro gained ~0.2%, Yen up ~0.3% (8:30 ET).

Markets now pricing in a 25-bp Fed rate cut next week, with growing odds of a 50-bp move.

Intro

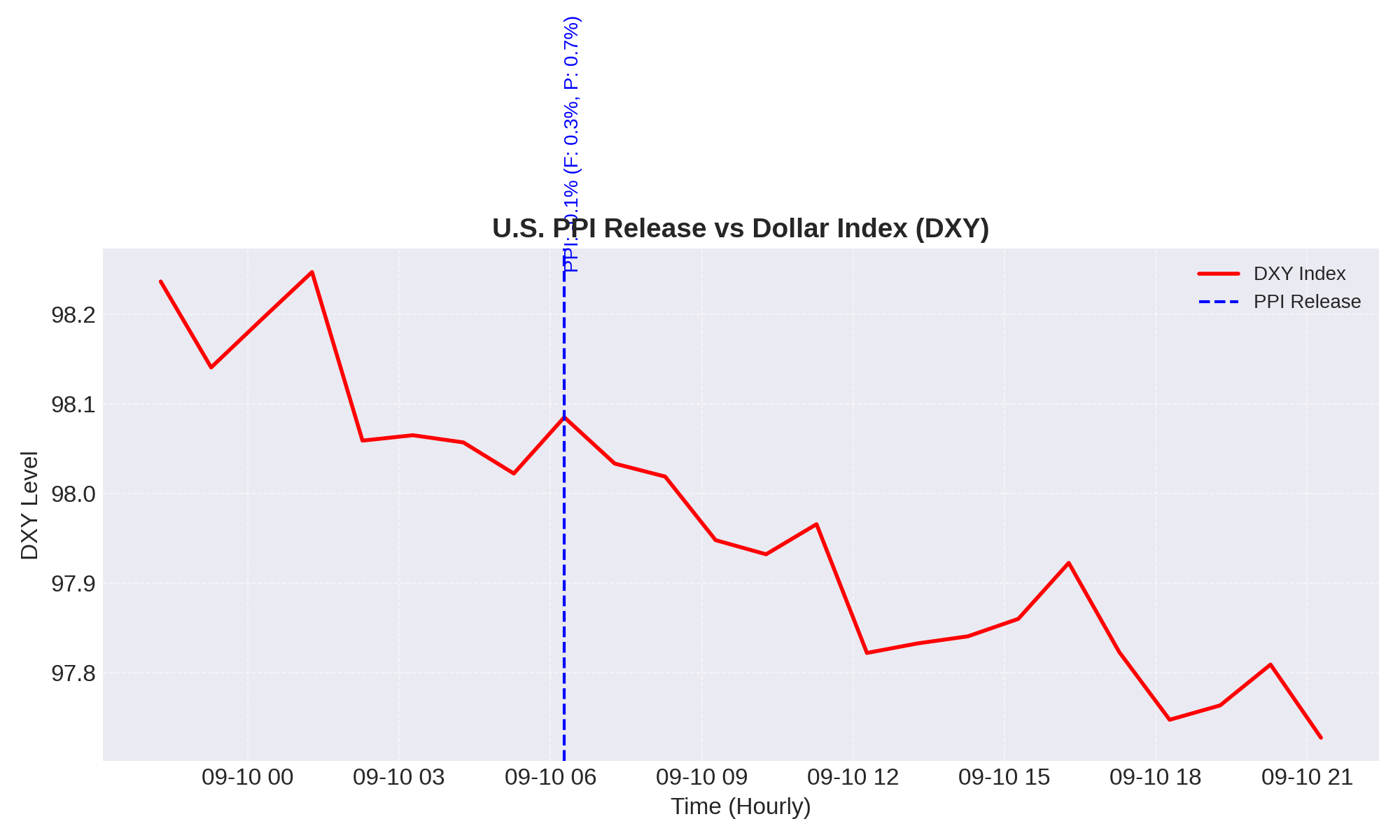

Here’s what moved markets: U.S. Producer Price Index unexpectedly dropped 0.1% in August, led by softer service sector margins. That’s fresh data and traders’ ears perked up—wholesale inflation is cooling fast. The dollar weakened, and fed-fund futures lit up with rate-cut bets. It’s a subtle crack, but enough to shift the angle. Traders, watch closely: inflation’s ripples just met the dollar’s wobble.

Today’s Economic Calendar

Producer Price Index (PPI, final demand): –0.1% MoM in August, versus +0.3% forecast (actual vs prior: –0.1% vs +0.3% vs +0.7%) ReutersAP News

Services PPI: –0.2% (vs +0.7% prior) Reuters

Goods PPI: +0.1% (vs +0.6% prior) Reuters

No CPI or Fed statements released yet today (unverified/not confirmed).

Market Reactions

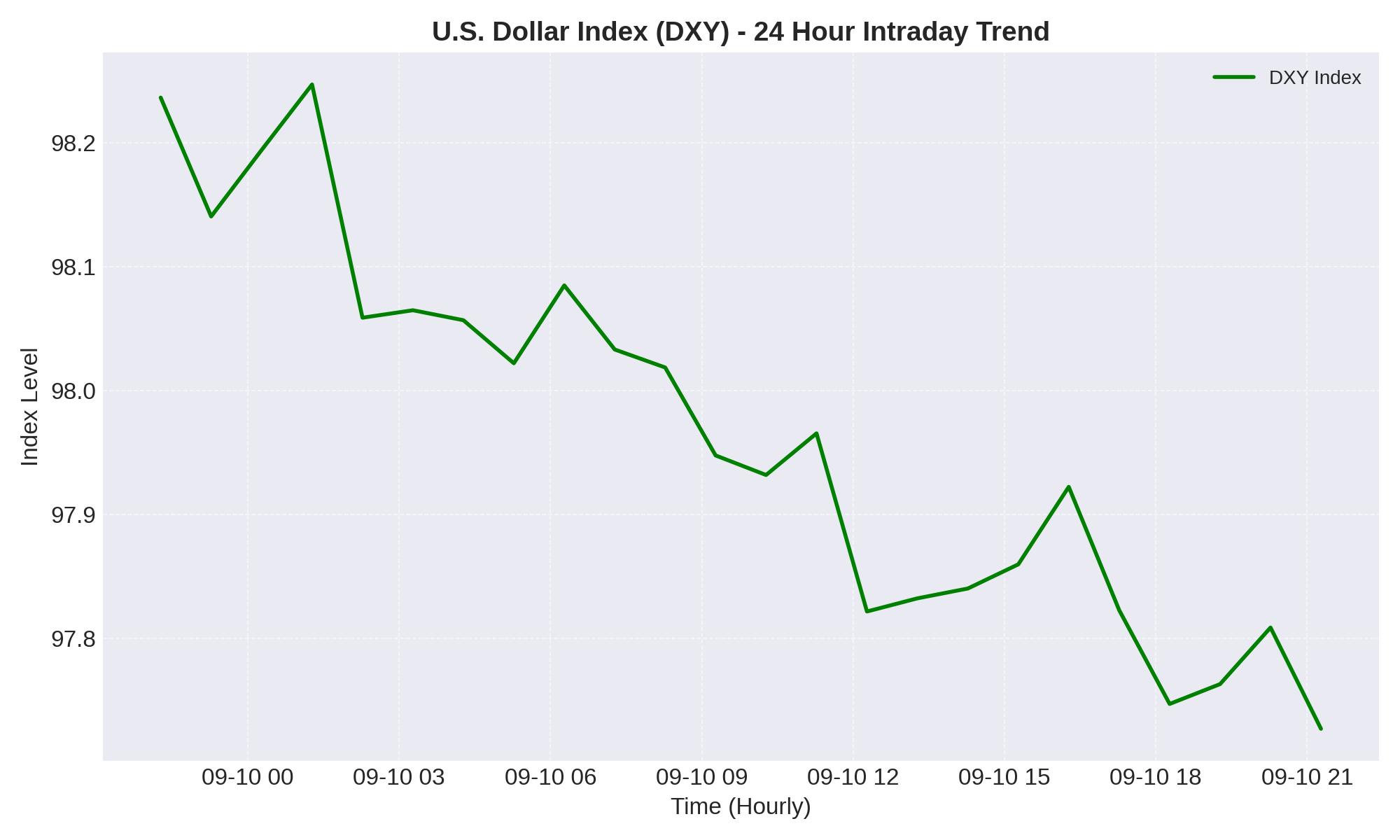

U.S. Dollar Index (DXY) dipped ~0.1% around 8:30 ET; EUR/USD up ~20 pips, USD/JPY down ~30 pips. Markets are still absorbing data.

10-year U.S. Treasury yield slumped ~5 bps to ~4.05%, firming expectations of easier policy.

Equity futures: S&P 500 and Nasdaq futures lifted ~0.3%–0.5% amid Fed-cut optimism Reuters+1.

Prediction & Forward Outlook

What’s next? If PPI stays soft, expect 30–50 bps of Fed easing priced in—not yet guaranteed, but gaining credibility. The dollar may continue to slip, especially if CPI also undershoots; 10-year yields could test below 4% again. Traders should monitor PPI core data tomorrow for confirmation.

Key Levels to Watch

EUR/USD: 1.0750 (8:30 ET) — fresh resistance.

USD/JPY: 146.00 — support zone to monitor (8:30 ET).

10-yr yield: 4.05% — breach may flip bond tone.

PPI core (if released) — will confirm trend direction.

FAQ

Q: Why did a 0.1% drop in PPI move the markets?

Wholesale price pressure has cooled more than expected. It’s a data shift that recalibrates Fed expectations quickly.

Q: Are Fed rate cuts now certain?

Not yet. A 25-bp cut is strongly priced in. A 50-bp move is considered possible—depending on CPI data.

Q: Does this mean inflation control is solid?

This is fact: PPI is weaker. Analysis: If core shows similar softness, markets will treat it as a sign of cooling inflation—but CPI is key.

Related Articles

Authors to Watch: Óhran Ó Dubhthaigh

Suggested Charts

PPI-USDxchange-20250910.png — U.S. Producer Price Index change vs intraday DXY movement

DXY-USDxchange-20250910.png — U.S. Dollar Index intraday 24-hr trend

Featured Article Image Filename

daily economic events USDxchange 20250910.jpg

Hashtags

#USD #PPI #Inflation #FederalReserve #RateCuts #Dollar #Forex #PPIdata #EconomicCalendar #10YearYield #Markets

Sources

PPI data: PPI falls 0.1% in August; services down 0.2% — Reuters Reuters

Confirmation of overall PPI decline — AP News AP News

Dollar reaction and market positioning — Reuters Reuters+1

Futures and equities response — Reuters Reuters+1

Fed rate-cut outlook — Reuters Reuters

Disclaimer: This information is for educational purposes only and is not investment advice.