Dollar softens as traders brace for key US inflation release

The dollar steadied but drifted lower into the morning as traders awaited the day’s main economic release — the US Consumer Price Index. Treasury yields held steady and equities hovered near highs. With inflation in focus, forex pairs saw cautious positioning. Today’s calendar is heavy on CPI and Fed speakers, and the USD’s path hinges on these numbers.

Quick Summary

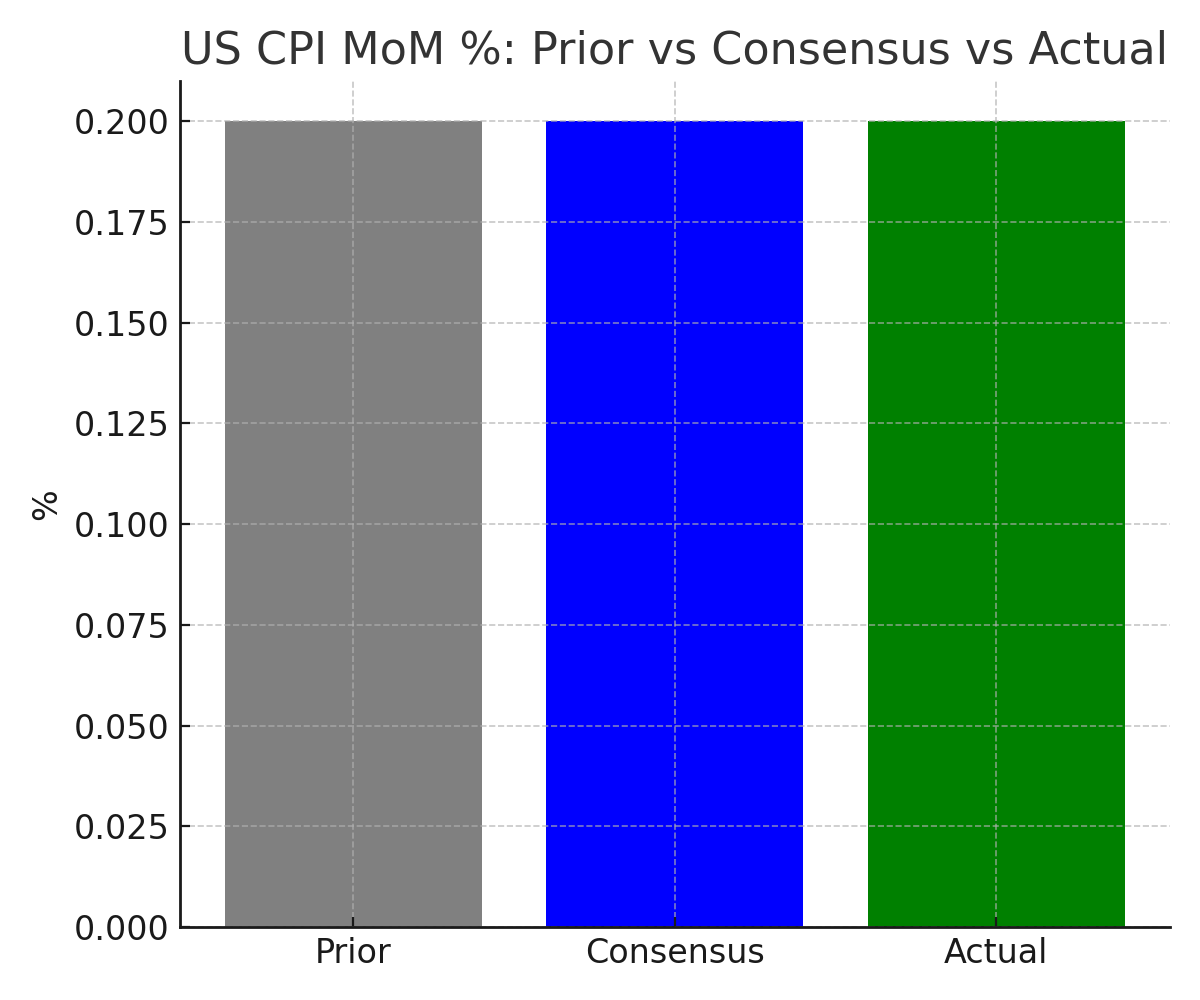

US CPI release due at 08:30 ET, consensus +0.2% MoM. BLS

Dollar index trades near 97.9, softer into data. Bloomberg

EUR/USD holds near 1.097, USD/JPY steady at 145.2. Investing.com

10-year Treasury at 4.1%, 2-year at 4.4%. Investing.com

Fed speakers scheduled: Jefferson and Barr later today. Fed.gov

Today’s Economic Calendar

The headline event is the August CPI release at 08:30 ET. Markets expect a 0.2% month-on-month rise, with core also at 0.2%. Year-on-year headline CPI is projected at 3.1%, down from 3.2%. Core CPI is seen steady at 3.6%. Last month’s print showed a softer core but firmer headline due to energy prices. Retail traders will also note weekly jobless claims at 08:30 ET, with consensus at 228k vs 227k prior. Two Fed officials — Vice Chair Philip Jefferson and Governor Michael Barr — are speaking later in the day, which could reinforce or challenge market expectations of a November rate cut.

Market Reactions

Ahead of the CPI, the dollar index was last near 97.9 at 04:00 ET. EUR/USD traded at 1.097, up around 25 pips from yesterday’s close. USD/JPY sat at 145.2, virtually unchanged. Sterling at 1.281 gained 15 pips. Treasury yields barely moved, with the 10-year at 4.1% (down 1 bp) and the 2-year at 4.4% (flat). Equity futures were steady, with S&P futures up 0.2%.

Prediction & Forward Outlook

Analysis: If headline and core CPI print in line, the dollar likely stays capped under 98. A softer print opens a path to 97.3 on DXY, while a hotter print revives upside toward 98.6. In my view, the Fed is looking through short-term noise and wants confirmation of trend before cutting. That keeps rates steady but keeps the dollar on the defensive unless inflation surprises.

Key Levels to Watch

DXY: support at 97.3, resistance at 98.6

EUR/USD: support 1.093, resistance 1.102

USD/JPY: 144.8 support, 146 resistance

CPI release at 08:30 ET is the inflection point

FAQ

What time is CPI released today?

At 08:30 ET, with consensus at +0.2% MoM headline and core. BLS

How is the dollar trading before CPI?

The DXY is around 97.9, slightly softer, with EUR/USD near 1.097. Bloomberg

Which Fed officials are speaking today?

Vice Chair Jefferson and Governor Barr, later this afternoon. Fed.gov

Related Articles

Bitcoin holds near 114K as dollar steadies and stocks stay strong

Dollar slips to 7 week low forex pairs react

Sources

Bureau of Labor Statistics https://www.bls.gov/news.release/cpi.nr0.htm

Bloomberg https://www.bloomberg.com/quote/DXY:CUR

Reuters https://www.reuters.com/markets/

Investing.com https://www.investing.com/rates-bonds/u.s.-government-bonds

Federal Reserve https://www.federalreserve.gov/newsevents/calendar.htm

Disclaimer

This information is for educational purposes only and is not investment advice.